Goldman Sachs is bullish on aluminum prices as it expects the Chinese government to implement supply-side reforms in the months ahead, the U.S. investment bank said in a note released Wednesday.

Goldman expects aluminum prices to hit $2,000 per metric ton in six months and $2,100 per ton in 12 months, analysts wrote in the note that came as the U.S. ordered a probe into Chinese imports. The three-month aluminum price on the London Metal Exchange was moving around $1,930 per ton in Asian trading hours Friday.

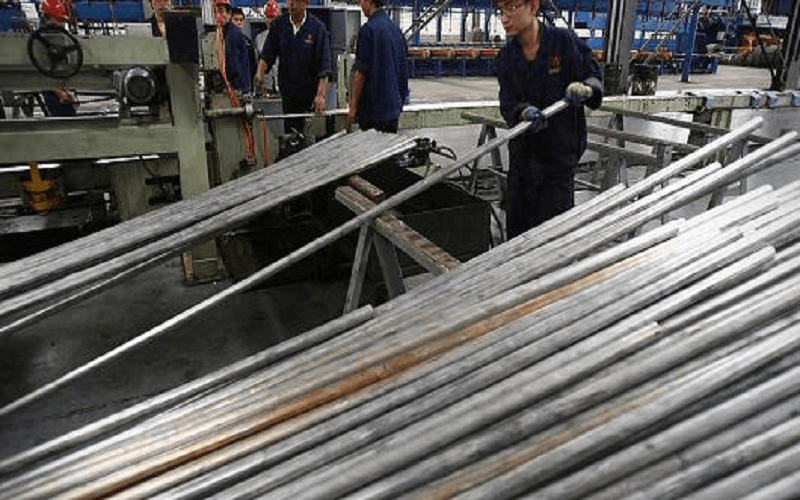

China is the world’s top aluminum producer.

Already, aluminum prices have outperformed most other commodities year-to-date, rising about 15 percent against steel and 3 percent against copper, Goldman noted.

“In our view, this strong performance has reflected an increase in the potential for aluminum to be the next target of supply-side reform in China, a tightening ex-China balance, and rising costs of production,” wrote the bank’s analysts.

“Further, global political developments may also be supportive of capacity and production cuts, given the two leaders of the U.S. and China launched a 100-day (trade) plan on April 7. These developments support our existing view that aluminum is the next target for supply-side reform in China,” they added.

Goldman did not mention the U.S. investigation but its expectation was based mostly on a recent Chinese government directive earlier this year ordering local governments to curb illegal and unapproved aluminum capacities.

In March, China’s aluminum production growth slowed to 3.4 percent from a year ago, the bank added. This year’s output is likely to be 34.4 million tons, 7.9 percent higher from 2016, but down from on-year production growth of 16 percent in 2016.

The Chinese government is on a drive to cut industrial overcapacity due to environmental concerns and as the country aims to transition from a manufacturing to service-driven economy.

Steel and coal prices have already risen by 70 and 80 percent, respectively, in the last 16 months due largely to the implementation of Chinese supply-side reforms, Goldman noted.

Consultancy Wood Mackenzie explained in a note Thursday that China does not export primary aluminum due to a 15 percent tax. Instead, the U.S. smelting industry is hit by downstream products as China currently offers a 13 percent rebate on exports such as flat-rolled products and tube and pipe. Aluminum foil receives a 15 percent rebate.

The LME aluminum price fell to $1,450 per ton in late 2015 from $1,866 per ton in 2014 due to concerns about excessive supply from China on the global markets. The price slump forced production cuts in the U.S. and in China’s higher-cost smelters.

In January, Barack Obama’s administration filed a complaint with the World Trade Organization, taking aim at China’s “subsidies to certain producers of primary aluminum”.

China is seriously concerned by the U.S. probe into imports of aluminum and hopes to resolve the dispute through talks, Commerce Ministry spokesman Sun Jiwen said on Thursday, according to Reuters.

Source: CNBC