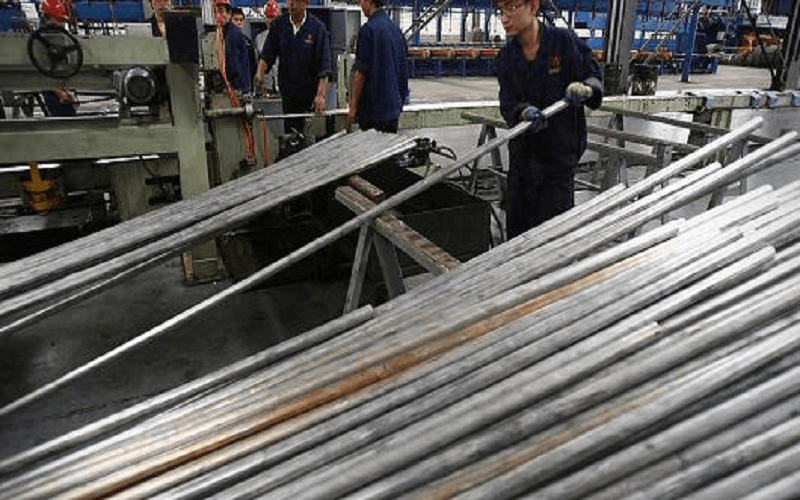

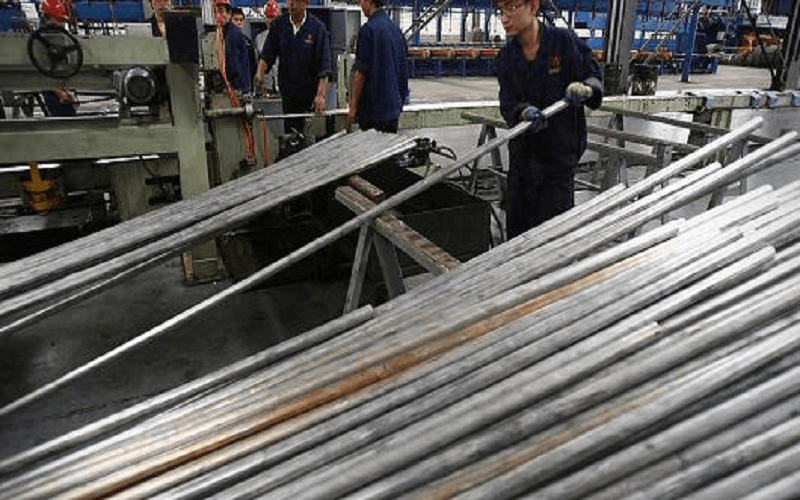

Aluminium trades above $2,000 a tonne for first time in nearly three years

The price of aluminium, which is used in everything from drinks cans to cars to girders for construction, has traded above $2,000 a tonne for the first time in almost three years as China continues to crackdown on pollution and reform its bloated industrial base.

Since the financial crisis, a supply glut has cast a shadow over the market for the lightweight metal. But this year the gloom has started to lift as China, which produces around half of the world’s aluminium, has moved to cut capacity.

Some of the measures, such as demanding that smelters run at lower operating rates in the winter, are aimed at combating air pollution. But others are an attempt to rein in excess capacity and place its sprawling aluminium industry on a more secure footing.

In a statement made public on Tuesday, China’s Shandong province, a key production hub, said it had ordered the closure of 3.21m tonnes of unlicensed smelting capacity. To put that figure in perspective, Wood Mackenzie, a consultancy, said it would represent roughly 9 per cent of China’s total aluminium production for 2017 and could flip the market into a significant deficit with “obvious implications for prices.” “The closure of illegal capacity in Shandong will send a strong message to market participants and domestic companies alike. A message that this time it’s different – provincial governments won’t shield any smelters evading the rules,” it said in a recent report.

Aluminium for delivery in three months on the London Metal Exchange rose as much as 1.75 per cent to $2,008 a tonne on Tuesday, extending gains since the start of the year to almost 18.5 per cent.

In 2016, aluminium averaged $1,604 a tonne. That performance boosted the LME Metal Index, which tracks the performance of six major industrial metals. It climbed to its highest level since 2014 on Tuesday. The rising aluminium price has been a boon to big producers such as Aluminium Corp of China, or Chinalco. Its shares have jumped more than 50 per cent over the past month.

Source: www.ft.com

Aluminum

Industrial Metals