Chinese firms including high-end equipment maker Jiangsu Hagong Intelligent Robot Co plan to bid for German industrial company FFT, likely to be valued at up to $712 million, two people familiar with the matter said.

China’s state-owned power company Shanghai Electric and Asian-European private equity firm AGIC Capital had also expressed interest earlier in the process, being managed by Morgan Stanley as FFT’s financial adviser, the people said.

FFT, a maker of manufacturing facilities for car makers and owned by private equity investor Aton, is expected to be valued at around 8-10 times its expected 2017 core earnings of about 60 million euros ($71.21 million), another person said.

Chinese interest in FFT comes as the world’s second-largest economy strives to boost locally-made products as part of a broad “Made in China 2025” plan, in ten sectors ranging from robotics to biopharmaceuticals.

The Chinese government issued new guidelines in August to support overseas investments in sectors such as advanced technology and high-tech manufacturing, while restricting deals in property and entertainment.

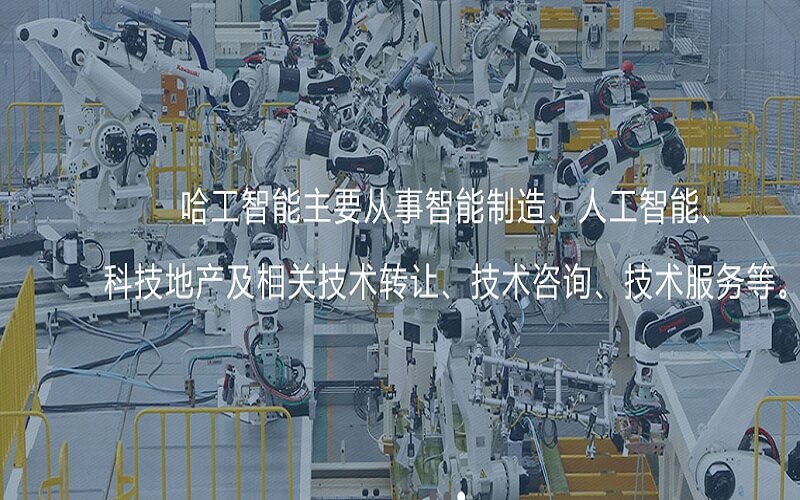

Jiangsu Hagong is among a growing number of Chinese firms seeking access to advanced German industrial technology as China pushes to bolster its high-end manufacturing.

A maker of industrial robots and auto automation equipment, Jiangsu Hagong could be the most serious bidder for FFT, said two of the people.

All the people declined to be named as the bidding plans are not public. FFT, Jiangsu Hagong, Shanghai Electric and AGIC Capital didn’t respond to requests for comment. Morgan Stanley and Aton declined to comment.

Chinese bidders’ pursuit of FFT comes a year after Shenzhen-listed Midea launched a $5 billion offer for German robotics maker Kuka, in a deal that triggered concerns that China was gaining greater access to key technologies.

China itself expressed concern in July after Germany became the first European Union country to tighten its rules on foreign corporate takeovers, following a series of Chinese deals giving access to Western technology and expertise.

The new regulations allow the German government to block takeovers if there’s a risk of critical technology going abroad.

However, several German companies, including Eisenmann and Eissmann Automotive, were pushing ahead with talks with potential Chinese buyers, and did not expect political interference, separate sources told Reuters in July.

German auto supplier ZF said in August it sold its Body Control Systems division to China’s Luxshare for an undisclosed amount.

Separate sources said in July that companies like FFT are not the type of technologically critical assets that Germany would look to protect.

“I don’t think there’s going to be any big issue,” said one of the people. “Midea closed the Kuka deal, which was much bigger and set a precedent for smaller deals. FTT’s management is also keen to sell the company to the Chinese.”

Source: Reuters