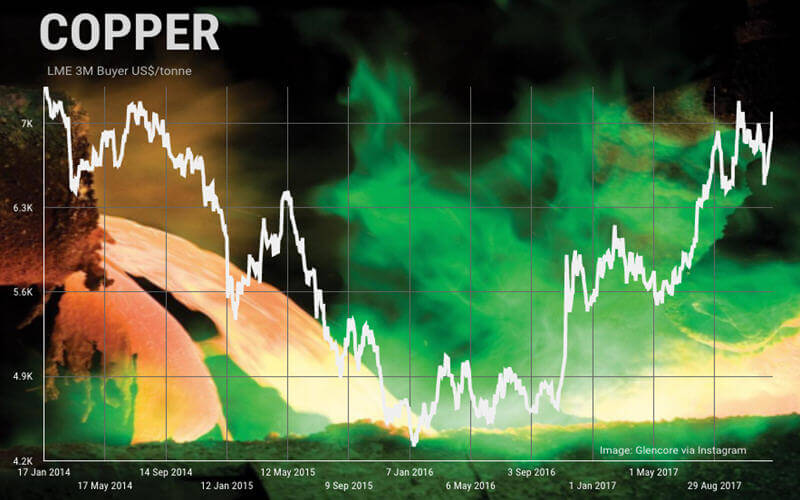

In brisk trading on Thursday in New York, Comex copper enjoyed its 11th straight session of gains touching a two-month high of $3.2185 a pound ($7,095 per tonne).

Copper is up nearly 27% in 2017 as it continues to recover from six-year lows struck early last year and expectations are for a positive if more modest performance next year.

SP Angel, a London, UK-based investment bank specializing in the resource sector, in a note to clients says “disruptive global supply surrounding wage negotiations are expected to tighten market conditions and draw the red metal price higher”:

It’s not just supply side issues – especially at mine level – that’s boosting copper’s prospects. Demand from China is holding up with the country’s refined copper production in November jumping nearly 10% from the same time last year to 786,000 tonnes, the highest rate in at least three years data from the National Bureau of Statistics showed Monday as smelters make the most of higher copper prices.

For the January – November period this year production is up 6.8% and 2017 should comfortably outpace last year’s total of 8.44m tonnes of refined copper production.

China’s smelters working at capacity helps to explain the decline in imports of refined metal and still growing concentrate imports.

Source: Mining.com