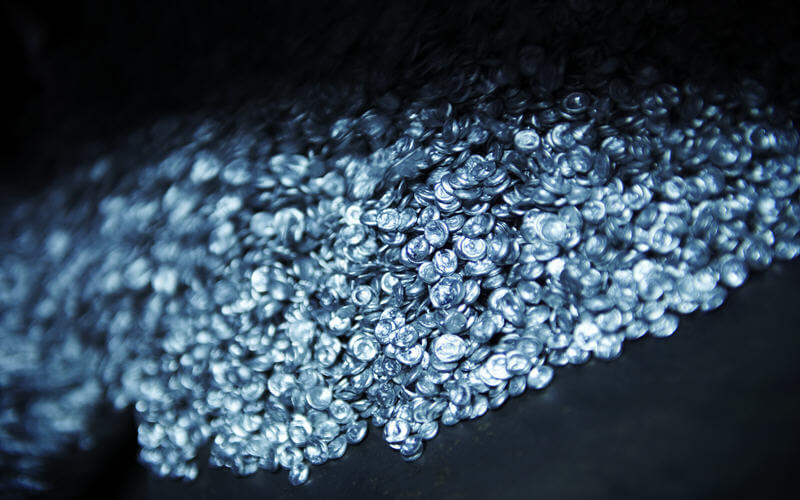

Zinc has hit its best level in a decade, joining a growing list of commodities reaching multi-year highs. The metal, which is used to rust-proof steel, rose $22 to $3,352 on Thursday after upbeat manufacturing data from around the globe stoked concerns about a supply shortage.

Data released by the London Metal Exchange showed zinc inventories at just above 180,000 tonnes – a ten year low.

Zinc advanced 28 per cent last year – and averaged $2,891 a tonne – helped by strong global growth and China’s environmental clampdown, which hit domestic production of the metal.

Chinese mines have historically been the swing producer in the zinc market, but Beijing’s determination to clean up its skies means supply increases will have to come from elsewhere.

Although higher prices are coaxing fresh supplies into the market – Glencore has announced plans to restart its Lady Loretta mine in Australia and tailings are about to be processed from the Century deposit in Queensland – many analysts think the price will remain supported in the near term.

In a report published earlier this week, analysts at Goldman Sachs said zinc prices could hit $3,500 a tonne over the next six months.

Zinc’s advance to a 10-year high came as palladium hit a record and crude oil rose above $68 a barrel for the first time since 2015.

Source: FT.com