Cameco’s profit beat estimates on improved uranium prices, cost-cutting drive

Canada’s top uranium producer Cameco (TSX:CCO) (NYSE:CCJ) injected some optimism in the depressed yellow powder market by posting a better-than-expected quarterly profit, on the back of improved prices and its efforts to cut production to ease a current oversupply.

Uranium prices have fallen more than 70% since the Fukushima disaster in 2011, remaining low since then as a result of global glut of the commodity and excess inventory in the industry.

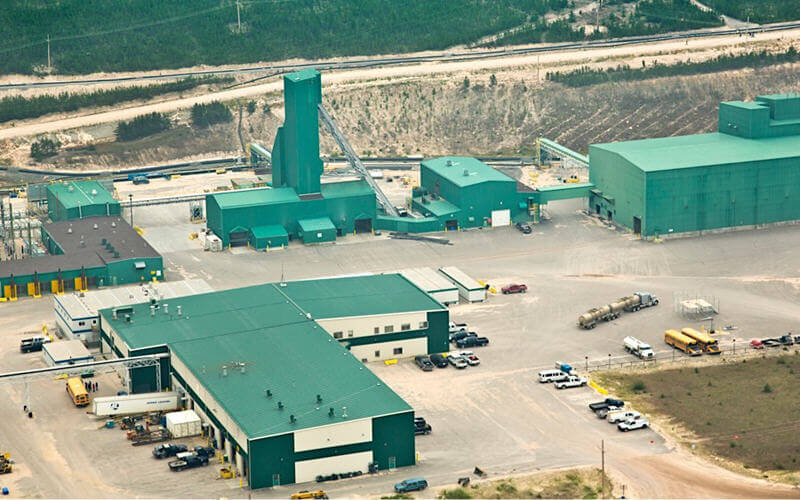

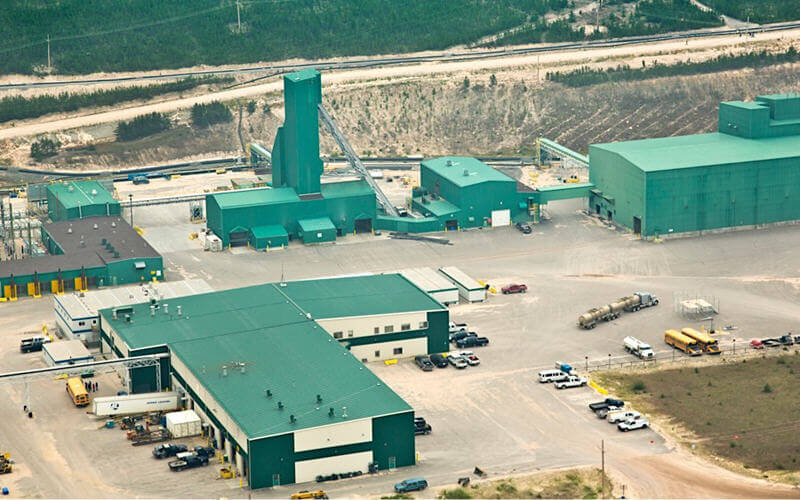

But Cameco’s announcement in November that it’s suspending operations at its flagship McArthur River mine in northern Saskatchewan for 10 months, and surprisingly deep three-year cuts by Kazakhstan’s state-owned Kazatomprom, have helped the market so far this year.

In fact, Cameco said its fourth-quarter average realized price for uranium increased by 4% to $39.44 per pound in the quarter ended Dec. 31.

Net loss narrowed to $62 million, or 16 Canadian cents per share, in the period, from Cdn$144-million, or 36 Canadian cents per share, a year earlier. Revenue, however, dropped by 8.8% Cdn$809 million, from Cdn$887 million.

Source: Mining.com

Mining

Uranium