Bill to relax key elements of Dodd-Frank reforms faces obstacles in House

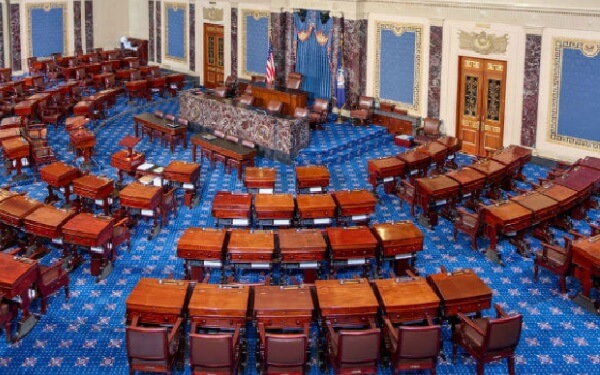

The US Senate has approved the biggest rollback of banking regulation since the financial crisis, passing a bipartisan package of legislation to help smaller banks that now faces new obstacles in the House of Representatives.

A small group of moderate Democrats joined forces with Republican senators on Wednesday evening to approve a bill that would relax key elements of the Dodd-Frank post-crisis reforms affecting small and mid-sized banks.

The bill would deliver the Trump administration its most significant legislative victory to date in its deregulatory drive, which has so far consisted mostly of rule changes made by bureaucrats as opposed to laws being rewritten by Congress.

Critics of the legislation, including prominent liberal Democrats led by Senator Elizabeth Warren, say it strips away vital consumer protections and will encourage more risk taking at the “too big to fail” giants of Wall Street.

The bill passed by a vote of 67-31 in the Senate.

Mitch McConnell, the Republican Senate majority leader, has called it “modest but essential”.

The legislation’s success is not assured in the House, which is generally reluctant to accept unmodified Senate bills, but the changes being sought by both conservatives and leftwingers threaten to alienate lawmakers on the other side.

The bill would open the way for some banks with assets of up to $250bn to be released from the Federal Reserve’s strictest supervisory regime, while giving regulators the option to loosen certain capital requirements for even larger institutions.

For small banks, the legislation would loosen mortgage underwriting standards for lenders with less than $10bn in assets and exempt the same institutions from the Volcker rule, which bans lenders from placing market bets with their own money.

Source: ft.com