AXMIN Inc (TSXV: AXM)

AXMIN Inc. (TSXV:AXM) is a Canadian-based exploration and development company with a strong focus on central and West Africa.

Gold prices had been boosted by safe-haven demand from the geopolitical crisis in the Middle East on Monday. However, as the latest economic data affected expectations of a Fed interest rate hike, gold prices fell into retracement over the next few days.

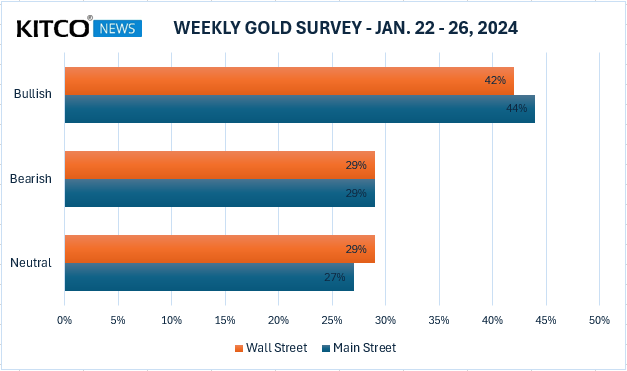

The latest Kitco News Weekly Gold Survey shows that institutional experts and retail investors are highly aligned in gold price forecasts.

Of the 14 Wall Street analysts who participated in the survey, six experts (42%) expected gold prices to rise next week, four analysts (29%) predicted that gold prices will fall, and another four analysts (accounting for the remaining 29%) were neutral on gold prices next week.

Among retail investors, 150 people took part in the online vote, with 66 retail investors (44 per cent) believing gold will rise next week. Another 44 (29 per cent) expected gold to fall, while 40 (27 per cent) were neutral on the near-term outlook for the precious metal.

Sean Lusk, co-head of commercial hedging at Walsh Trading, said that gold is losing support at the current $2,000 level. Looking at the current economic data, there is not much to worry about in the U.S. economy.

Darin Newsom, senior market analyst at Barchart.com, said the trend on gold’s weekly chart remains down. The S&P 500 is at an all-time high, which suggests that some of the investment money will be moving away from the precious metal. If a short-term uptrend cannot be established from around $2,000 at the opening of next week, the odds are that gold prices will continue to move down.

Adrian Day, president of Adrian Day Asset Management, on the other hand, believes that gold can build on this week’s consolidation and make new gains next week.

James Stanley, senior market strategist at Forex.com, has shifted his judgement for next week from bearish to bullish, arguing that gold prices did not fall below $2,000 this week despite the efforts of shorts and have formed a bullish pattern in the form of a falling wedge.Stanley said that $2,059, $2,075 and $2,082 are the next few resistance levels to overcome.

Jim Wyckoff, senior analyst at Kitco, also expects gold prices to move higher next week. He said that gold prices will strengthen early next week as the bulls gain some momentum later in the week.

The spot price of gold was trading at $2,028.44 an ounce by Friday’s close, up 0.31% on the day but down a cumulative 1% for the week.