The oil and gas industry saw heavyweight M&A deals in 2023, including massive deals like ExxonMobil‘s acquisition of Pioneer Natural Resources and Chevron‘s acquisition of Hess Energy. And industry analysts and executives expect the strong momentum of M&A activities in 2023 to continue into 2024.

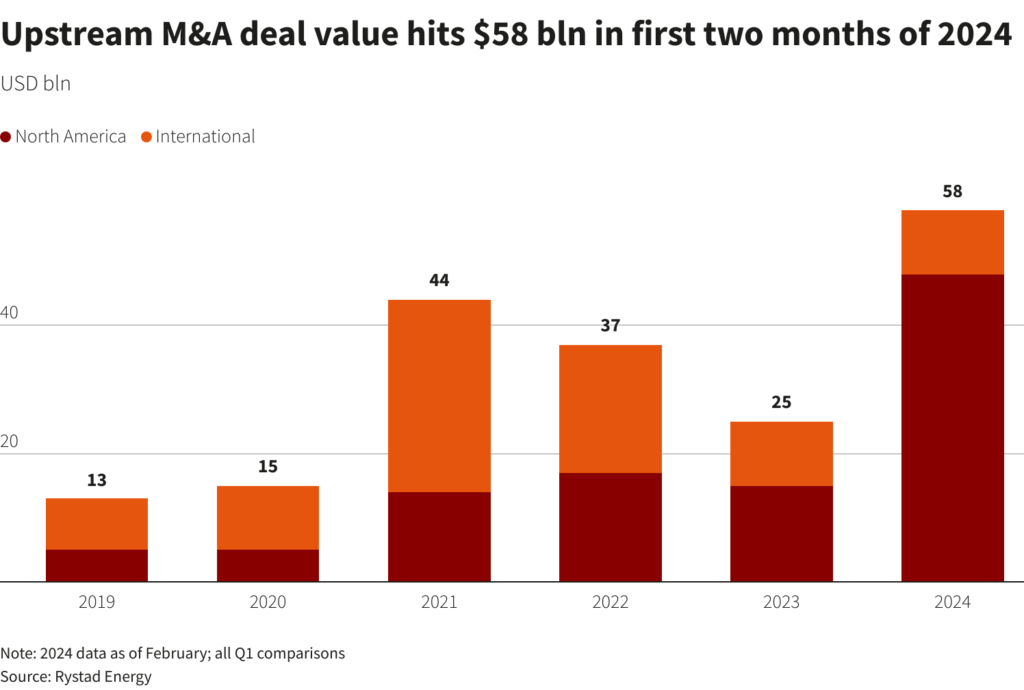

Industry experts estimate that continued consolidation in the U.S. shale oil sector has pushed the value of global M&A deals in the oil and gas exploration industry to its highest level since the first quarter of 2017, Reuters reported.

Data from analyst firm Enverus says deals already announced in the first two months of 2024 are worth more than $55 billion. Taking advantage of rising share prices, publicly traded oil and gas companies are on a merger spree to gobble up smaller companies.

Some of the major deals announced in the first two months of 2024 include Diamondback Energy’s offer to buy Endeavor Energy Partners for $26 billion earlier this month and APA Corp.’s agreement in January to buy Callon Petroleum for $4.5 billion.

Deals in January and February 2024 have totalled $68 billion, the highest level since the first quarter of 2017 and more than double the value of deals announced in the first quarter of 2023, with deals involving U.S. shale oil companies accounting for more than 80 per cent of the total value, Enverus said.

With an estimated $55 billion worth of assets still for sale in the US shale region, the dominance of shale oil in overall M&A activity is expected to continue, said Palash Ravi, senior M&A analyst at Rystad Energy.

At the same time, increased international M&A activity is helping to increase overall deal values. According to Rystad Energy, large European players are driving most of the activity, accounting for 66 per cent of total international M&A deals to date in 2024.

Industry experts also expect the US shale gas industry to see some consolidation in 2024 after a period of downturn due to falling natural gas prices in the Henry Hub, USA.

Analysts believe that in the past two years, international oil prices are at relatively high levels and continue to fluctuate significantly, to a certain extent, to promote the restoration of investment confidence in the global oil and gas resources M&A market, but also to make the operating conditions of some oil companies improved significantly, with the ability to carry out new oil and gas assets mergers and acquisitions activities.

In 2024, the U.S. shale will become the focus of the global oil and gas mergers and acquisitions market in the region. In addition, the Middle East, Europe and even Australia are also likely to be the regions where large oil and gas M&A deals will focus on.