Silver Storm Mining Ltd. (TSXV:SVRS)

Building the Next Latin American Silver Producer.

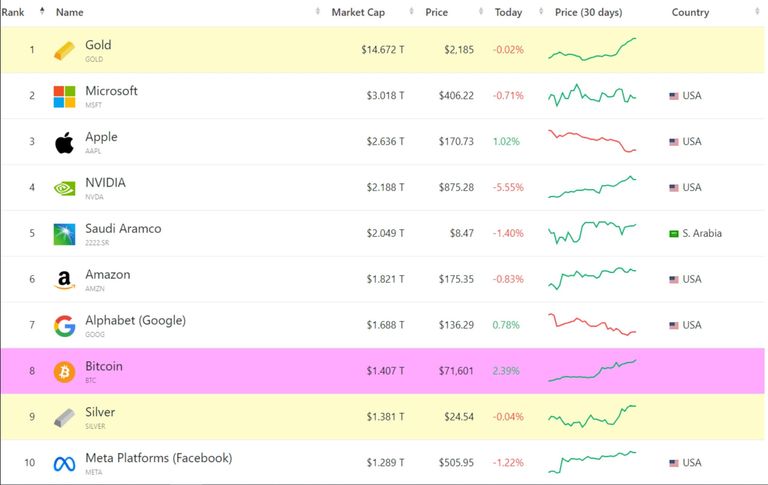

This week, news of record high prices for gold and bitcoin continued to become headlines in many financial websites, making gold’s sister metal silver look bad.

Adding insult to injury, when the price of Bitcoin soared to $72,000, the cryptocurrency’s total market capitalization reached $1.4 trillion, overtaking silver as the eighth most valuable asset in the world.

However, market experts point out that silver has always been lagged, but it’s worth pointing out that the silver market has seen strong momentum this week, with bulls pushing the spot silver price up to near $25 an ounce on Wednesday afternoon (13 March), which is a positive sign.

If Bitcoin pulls back, silver could retake the eighth position. As for bitcoin itself, holding this position will also be a tough task.

Etan Hunt, editor of Dailycoinpost, said that the price of bitcoin has soared more than 60 per cent since the start of 2024, and 40 per cent in the past two weeks alone. The price surge highlights the transformative potential of Bitcoin as decentralized digital asset. However, gold and silver remain the ultimate choice for investors when it comes to a store of value.

Considering the steady performance of precious metals in a time when the economy and stock market are in a tough spot, coupled with the fact that the Federal Reserve will cut interest rates sooner or later in 2024, most market analysts believe that precious metals are a better investment option than cryptocurrencies, especially silver, which is still a long way from its all-time highs.

Typically, silver often outperforms gold in the second half of a bull market in precious metals. Now, silver’s market capitalization being overtaken by Bitcoin could be a catalyst for silver’s price to try and catch up.

Fawad Razaqzada, a financial markets analyst at StoneX Group, says silver will take off sooner or later and could soon surge to $50 an ounce after breaking above $30.

He noted that technical analyses of silver suggest that it could break out of a consolidation that has lasted 3.5 years, and that short-term traders should pay close attention to daily price action to see if silver is likely to make a move toward $30.

The analyst reminds investors that silver has a dual identity as a precious metal and also an industrial metal. Silver prices have been pressed to the floor due to concerns about weak demand for industrial metals in China. However, with signs that China is turning things around and with the government setting an aggressive 5 per cent growth target, investors are likely to see stronger demand for industrial commodities such as copper and silver this year. 2024 could be the year of silver eventually.

If you’re interested in investing in silver, you might want to keep an eye on this company: Silver Storm Mining Ltd. (TSXV:SVRS). Silver Storm Mining Ltd. holds advanced-stage silver projects located in Durango, Mexico. Golden Tag recently completed the acquisition of 100% of the La Parrilla Silver Mine Complex, a prolific operation which is comprised of a 2,000 tpd mill as well as five underground mines and an open pit that collectively produced 34.3 million silver-equivalent ounces between 2005 and 2019. The Company also holds a 100% interest in the San Diego Project, which is among the largest undeveloped silver assets in Mexico.

Disclaimer: Investing involves risk, and individuals should conduct thorough research and seek professional advice before making financial decisions. NAI is being compensated for this content. Materials contained in this content are for information purposes only and is not intended to constitute an offering of securities in any jurisdiction. Nothing on this content should be construed as an offer, solicitation or recommendation to buy or sell products or securities.