As leading carmakers aim to electrify their models and Tesla’s Model 3 rolls off the production line, investors are looking to increase their exposure to copper, betting that the advent of battery-powered vehicles will boost prices and demand for the metal.

But rather than just buy shares in big miners, where copper is often part of a wider portfolio of commodities, they are also backing small companies who offer more leverage to the copper price, albeit with much higher risks. Their interest has already led to big share price gains for companies that are searching for deposits in new and challenging locations. These include SolGold, an Ecuador-focused explorer, and Ivanhoe Mines, the latest venture of mining entrepreneur Robert Friedland. Nevsun Resources, Atalaya Mining and Georgian Mining are other companies attracting attention.

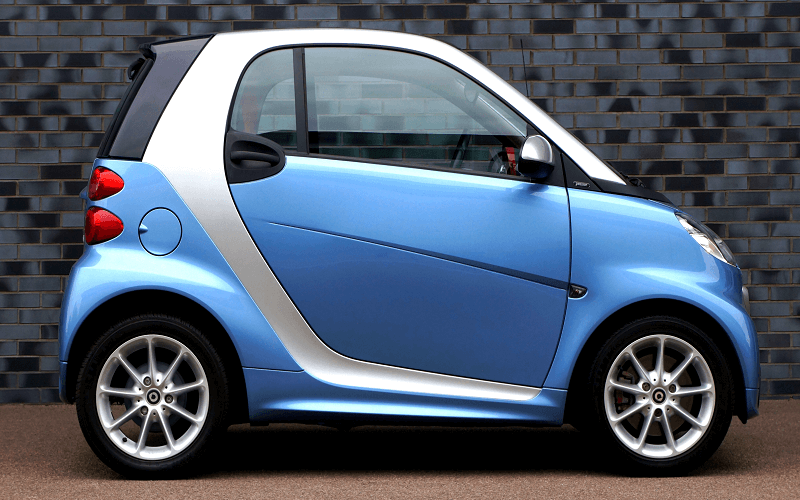

Electric vehicles use more copper than cars fitted with internal combustion engines. Copper is needed in the lithium-ion batteries that power the vehicles, as well as their motors, inverters and charging points. This wide range of uses sets copper apart from other raw materials such as lithium, which have more concentrated usages in battery-powered cars.

If electric vehicles achieve widespread consumer adoption, experts say it will require a substantial increase in copper supply that cannot be met by simply expanding existing mines. The gap will have to be filled by new projects that will require higher copper prices to make them viable.

“The world is electrifying and you need a lot more copper than we’ve previously been using,” says Nick Mather, chief executive of SolGold. “And a lot more than we’ve previously been producing.”

How much metal will be needed is a matter of intense debate in the financial community. Some analysts believe the take-up of electric vehicles will be so quick that it will require the mined copper supply base — currently 20m tonnes — to double over the next 20 years. The majority are more circumspect, saying anything between 1.7m and 5m tonnes of extra copper will be needed by 2025. But that will still present a challenge since it is getting more difficult and expensive to crank up production from the world’s largest copper mines — some of which are more than 100 years old — and find new deposits in politically stable jurisdictions.

The amount of copper needed in an electric vehicle will be determined by the size of batteries used and the power of the charging stations. IDTechEx, a consultancy, says an electric vehicle will need a total of 83kg of copper, while Glencore, one of the world’s biggest copper producers, reckons 138kg will be needed for the car and an additional 20kg for the charging point. For mining investors looking to bet on the electrification of cars, big diversified mining companies such as Glencore, BHP Billiton or Rio Tinto are one way to get exposure. But they also produce other commodities that will not get a boost from electric vehicles, such as iron ore, oil and coal.

That has driven investors to more “pure-play” companies such as Freeport-McMoRan, First Quantum and Southern Copper but also small-cap miners, which have had a tough time in recent years, struggling to raise finance for their projects.

As commodity prices have picked up over the past year and the buzz around electric cars has grown louder, sentiment towards the so-called “juniors” has improved, says John Meyer, partner at London-based brokerage SP Angel. “Funds have returned to juniors in the last six months,” says Mr Meyer. “Investors can see electric vehicles driving significant demand and any new company coming along with sensible projects going forward is very popular.”

SolGold is a case in point. Shares in the company, which is still mapping its copper and gold deposit in a 50 square kilometre concession in the jungles of Ecuador, have surged by almost 900 per cent in the past year, giving it a market value of $750m. That is despite the fact that production could be at least 10 years away. Last October SolGold fended off an attempt by BHP to buy a 10 per cent stake, in an indication of the desire of the global mining majors to get access to big, new copper deposits. Instead, it sold the stake to Australia’s Newcrest for $33m.Analysts have compared the SolGold project to Rio’s giant Oyu Tolgoi copper deposit in Mongolia.

Another beneficiary has been Toronto-listed Ivanhoe Mines. Its founder Mr Friedland is evangelical about the future of copper, due to its uses in renewable energy and electric vehicles. Demand will only increase as governments such as China’s tackle air pollution, he says. “You are going to need a telescope to see the copper price by 2020,” Mr Friedland told investors in London earlier this month.

Ivanhoe is developing the Kakula and Kamoa copper deposit in the Democratic Republic of Congo with China’s Zijin Mining. It says the discovery is the largest copper discovery ever made in Africa and the fifth largest copper deposit in the world, with indicated resources at more than 30m tonnes of copper.

Shares in the company have risen by more than 300 per cent over the past year. It is now valued at $3bn. Still, even those projects may not be enough to meet the demand generated by electric vehicles in a rapid adoption scenario, say analysts. Paul Gait of Bernstein Research says the only way to guarantee adequate supplies and incentivise new projects is much higher prices.

Copper has risen 9 per cent this year and is currently trading around $6,000 a tonne on the London Metal Exchange. “It took $10,000 a tonne copper and super-normal margins to lift production from 15m to 20m tonnes during the commodities super cycle [between 2003 and 2013]. At the very least, that is going to be required again,” he says. Investors in SolGold, Ivanhoe and other small-cap copper companies will be hoping he is right.

Source: www.ft.com