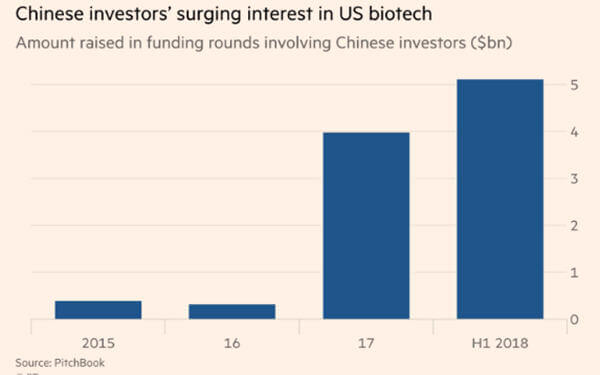

Chinese venture capital investment into US biotech companies in the first half of the year has already surpassed the record set for the whole of 2017, underlining Beijing’s focus on medicine as a strategic sector — a development that has flown under the radar of regulators in Washington.

Chinese funds participated in investment rounds in US biotech companies worth $5.1bn in the first half of this year, beating the $4bn in 2017, the first year of large Chinese inflows into the sector, according to Seattle-based data provider PitchBook.

“We’ve seen tremendous growth,” said Kitty Lee, a partner at consultancy Oliver Wyman. “You can’t forget how much the Chinese government is pushing biotech as a strategic industry and trying to build up the industry to become competitive globally. A natural part of that is investing.”

China is now a significant source of funds for US biotech start-ups. Such companies raised about $10bn in VC funding last year, according to PitchBook, meaning Chinese investors participated in about a third of rounds by value.

For instance, California blood-testing company Grail raised $300m in May from a consortium of greater China-based funds, including Ally Bridge Group, China Merchant Securities International, HuangPu River Capital and ICBC International.

“American companies usually have obvious advantages in terms of cutting-edge innovation, originality and IP,” said Frank Yu, founder of Hong Kong-based Ally Bridge. “We also help bring some the technologies we have invested in overseas back to China”.

Chinese direct investment into the US has grown rapidly in recent years, reaching $46bn in 2016, prompting concern in Washington, which blocked several deals concerning sensitive technology. The Trump administration last week dropped a plan to place new limits on Chinese investment.

But the biotech industry, highlighted as one of 10 key sectors in Beijing’s latest five-year plan, has not been at the forefront of controversy.

“We have no connections with the Chinese government or government-owned entities whatsoever,” said Mr Yu. “I am not particularly worried about the Trump administration’s policies hindering our investment.”

Analysts said regulatory scrutiny could increase. “Thus far the sector has not been a big focus of the US-China dialogue around technology, however, that story is still being written,” said Vikram Kapur, a partner at consultancy Bain.

Chinese investors have focused on sectors such as cancer where there is potentially huge demand for treatment in China. “The promise of being able to bring drugs to market in the second largest pharma market in the world, at the same time as they would come to market in the US is a big part of the value proposition,” said Mr Kapur.

Chinese investment is pushing up already high valuations in US biotech, but the flow of funding is likely to continue due to large pools of money being raised in China for healthcare investment. Chinese healthcare VC and private equity funds raised $40bn last year, according to consultancy ChinaBio, but invested just $11.7bn domestically.

Chinese investors have also pursued European biotech companies. Sequoia Capital China co-led a $27m funding round into British flu vaccine start-up Vaccitech in January.

“Domestic biotech valuations are incredibly high, so if you look at that then some of the investments in the US and Europe don’t look that high,” said Ms Lee, adding that when it comes to IP “some protections are incumbent on the companies to protect what they do”.

Source: FT.com