RepliCel Life Sciences Inc (TSXV:RP)

RepliCel is a regenerative medicine company developing autologous cell therapies that address diseases caused by a deficit of healthy cells required for normal healing and function.

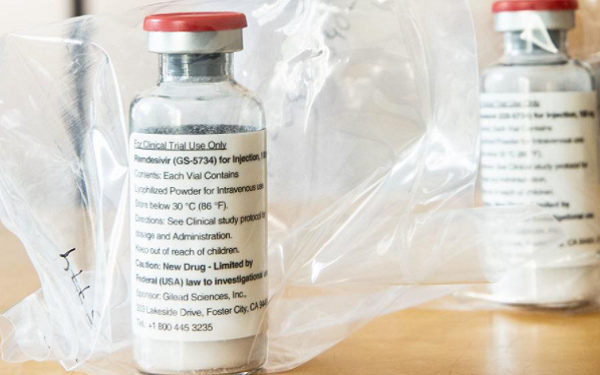

The FDA’s website indicates that it has fully approved Gilead Sciences’ (GILD +0.8%) Veklury (remdesivir). It does not specify the specific indication, but the company completed its rolling application in early August for severely ill hospitalized COVID-19 patients.

The agency granted emergency use authorization (EUA) for these patients on May 1.

Update: The nod is for adults and pediatric patients at least 12 years old and weighing at least 40 kg with COVID-19 requiring hospitalization.

The FDA has also issued a new EUA for Veklury for hospitalized pediatric patients under 12 years of age and weighing at least 3.5 kg or hospitalized pediatric patients weighing 3.5 kg to less than 40 kg with suspected or laboratory confirmed COVID-19 for whom the use of an intravenous agent is clinically appropriate.

The Phase 3 COVE study of mRNA-1273 has 30K participants. At this point, 25,650 have received their second vaccination.

From the press release: “Moderna (NASDAQ:MRNA) will determine whether to submit a dossier to FDA requesting Emergency Use Authorization based on an assessment of whether the potential benefit of the vaccine outweighs the potential risks once the 2 months of median safety follow-up have accrued.”

It’s a randomized 1:1 placebo-controlled trial at the 100 ug dose level. The primary endpoint is the prevention of symptomatic Covid-19 disease. Key secondary endpoints include prevention of severe COVID-19 disease and prevention of infection by SARS-CoV-2.

Shares are up 3.75%.

cloudMD Software & Services (OTCPK:DOCRF) -1% PM, signed a binding term sheet to acquire 100% of Medical Confidence, a revolutionary health care navigation platform with proven results in wait time reduction and patient satisfaction, for $6M.

The consideration is payable $2.25M in cash, $2.25 million in shares and a performance-based earnout of $1.5M (payable 50% in shares and 50% in cash in equal annual issuances over a period of two years).

Through the integration with CloudMD, the combined suite of health care solutions will offer one, multi-functional platform which addresses total health (mental and physical care) and provides a direct and existing pathway into corporations and insurers.

It would leverage a database of 17K specialists to reduce wait times for specialist appointments and medical procedures resulting in better access to care and return to work outcomes.

Acquisition will be immediately accretive to CloudMD as Medical Confidence generated ~$2M in revenues with EBITDA margins exceeding 26% over the last FY ending March 2020.

Medical Confidence drives revenue through retainer-based, multi-year contracts with enterprise clients, and has experienced year over year revenue growth of 35%+ in last FY.

CloudMD intends to integrate Medical Confidence into its suite of products to realize and optimize revenue synergies and cross-selling opportunities.

Retrophin (NASDAQ:RTRX) has agreed to acquire privately-held Orphan Technologies and add OT-58, a novel enzyme replacement therapy in Phase 1/2 trial for the treatment of classical homocystinuria (HCU), a rare metabolic disorder characterized by elevated levels of plasma homocysteine that can lead to life-threatening thrombotic events.

Under the terms of the agreement, Retrophin will pay an upfront payment of $90M, as well as up to $427M in milestones payments. Retrophin will also pay a tiered mid-single digit royalty on future net sales of OT-58 in the US and Europe, and potentially make a milestone payment in the event a pediatric rare disease voucher is granted.

OT-58 has been granted Rare Pediatric Disease and Fast Track designations by the FDA, as well as Orphan Drug designation in the US and Europe.

The transaction is anticipated to close during the quarter.

Danaher (NYSE:DHR) Q3 results:

Sales: $5,883.2M (+34.4%).

Net income: $883.5M (+32.3%); EPS: $1.16 (+30.3%); non-GAAP EPS: $1.72 (+62.3%).

Cash flow ops: $1,722.7M (+93.0%).