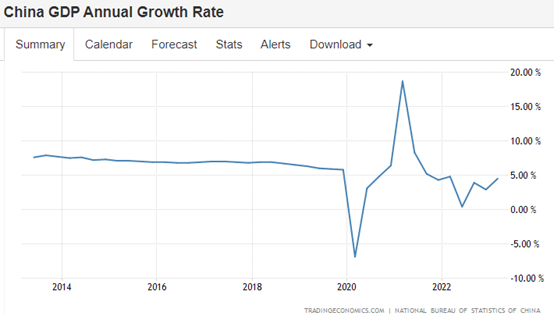

On April 18, National Bureau of Statistics of China released the first quarter economic data of China. According to preliminary accounting results, China’s gross domestic product (GDP) grew 4.5% year-on-year to RMB 2,449.97 billion in the first quarter, up 2.2% sequentially from the fourth quarter of last year. This GDP figure rebounded more than expected.

Another surprising figure is that the total value of China’s goods trade imports and exports in the first quarter was RMB 9.89 trillion, up 4.8% year-on-year. Previous market expectations were a year-on-year decline. This is mainly due to the driving force of China’s trade is gradually shifting from developed economies to emerging economies. In March, China’s export growth increased by 14.8% year-on-year, with ASEAN and Russia becoming the main pulling force for China’s exports. The share of China’s exports to the United States has continued to decline since mid-2022, having fallen to roughly 14%.

Following the release of key Chinese economic data, J.P. Morgan raised its 2023 growth forecast for China to 6.4 percent from 6 percent, saying the latest quarterly data suggest further growth ahead. Citi raised its 2023 growth forecast for China to 6.1 percent from 5.7 percent, saying the economy is well on track for a post-epidemic recovery, led by consumption and services. UBS also raised its 2023 growth forecast for China to 5.7% from 5.4%, as the economy recovered better than expected in the first quarter of 2023, driven by a strong rebound in consumption and real estate.

China’s consumption led the recovery in the first quarter, with total retail sales of consumer goods increasing 5.8% year-over-year to RMB11,492.2 billion yuan, and in March, total retail sales of consumer goods increased 10.6% year-over-year to RMB3,785.5 billion yuan. Real estate investment is a major drag on China’s economy. Affected by China’s strict epidemic control in previous years, Chinese residents are keen to save rather than buy houses, making this pillar of China’s economy a shortfall in growth.

On the contrary, the United States, one of the three largest economies in the global economy. The U.S. economy, which suffers from high inflation, is starting to flame out after consecutive interest rate hikes by the Fed. On March 22, the Fed lowered its U.S. gross domestic product (GDP) growth forecast for 2023 to 0.4%; and lowered its U.S. GDP growth forecast for 2024 to 1.2%. A number of U.S. banks have bankrupted under the impact of successive sharp rate hikes by the Fed, including Silvergate Bank, a company that provided services to the cryptocurrency industry, Silicon Valley Bank, which ranked 16th in assets quantity, and Signature Bank.

Another large economy, the eurozone, is also suffering from high inflation. On March 30, the ECB raised its forecast for eurozone GDP by 0.5 percentage points and expects it to fall to 1% in 2023, down from 3.6% in 2022. However, ECB believes that eurozone’s growth outlook subjects to many downside risks. If the Ukraine crisis and market tensions persist, it will weaken confidence and lead to tighter credit conditions.

With two of the world’s three largest economies suffering from high inflation and interest rate hikes, many countries around the world are now counting on China’s rapid economic recovery to contribute to global economic growth. Of course, the just-released Chinese economic data for the first quarter comes just three months after the country’s economy restarted, and higher economic growth is to be expected as fixed asset investment and resident confidence recover. Once the Chinese economy’s investment and consumption dynamics are fully unleashed, this will favor the trend of commodities.