Unlike Bitcoin or other popular cryptocurrencies, which are entirely decentralized, a Central Bank Digital Currency (CBDC) is issued by the central bank as a digital version of that country’s fiat currency, fully regulated and backed by monetary reserves.

When you think of the Bahamas, cryptocurrency may not be the first image that comes to mind. However, that may change with the launch of the Bahamian Sand Dollar, the country’s new digital currency.

The Bahamas now joins China and Cambodia as countries with their own digital currency. It can easily be loaded into smartphones and digital wallets and used to buy everything from a cold beer to paying your bills.

But in the race for mainstream digital currency adaptation, who will come out on top – CBDCs, cryptocurrency, or something else?

Unlike Bitcoin or other popular cryptocurrencies, which are entirely decentralized, a Central Bank Digital Currency (CBDC) is issued by the central bank as a digital version of that country’s fiat currency, fully regulated and backed by monetary reserves.

Digital currencies aren’t standard issue yet, but with the meteoric rise of cryptocurrency, central banks may not have a choice. At stake for central banks is their ability to compete with the efficiency and lower transaction costs associated with cryptocurrency while maintaining financial stability.

A recent survey found that 86% of central banks are actively exploring developing their own digital currencies, with 15% already progressing towards research for pilot project releases.

China has been leading the pack, having invested more than $300 million worth of digital renminbi into its economy so far. However, other central banks, including The Bank of Japan, The Bank of England, and The Central Bank of Sweden, are not too far behind.

Despite the rapidly growing popularity of Bitcoin and other notable cryptocurrencies, central banks may have more to worry about with the rise of ‘stablecoins’. Stablecoins are non-government-issued digital tokens whose value is pegged to some outside reserve asset, like US dollars or gold, in an attempt to stabilize the price.

By design, stablecoins are substantially less volatile than other types of cryptocurrency, making them increasingly popular to transact with both domestically and internationally, particularly for developing economies. A recent letter from the OCC US regulators gave authority to National Banks and Federal Savings Associations to use stablecoins (and other relatively stable cryptocurrencies) for banking-related services. JP Morgan Chase is one notable US financial institution currently allowing the use of digital coins.

Stablecoins have also been gaining traction in another very important area – with large technology and financial companies looking to integrate stablecoins into their social media and eCommerce platforms.

While there are several well-known stablecoins in circulation and dozens of lesser-known coins, Tether is currently the most valuable, with a market cap of over $57 billion. However, Tether could soon face stiff competition from Diem – a Facebook backed stablecoin set to launch later this year.

With cryptocurrencies and other digital coins gaining increasing popularity with mainstream users, the need for CBDC’s becomes clear. Central banks are facing the real risk of losing control over their monetary policies and, with that, the ability to manage inflation and maintain financial stability. CBDC’s provide users with the efficiency of a digital currency in a world that is increasingly going cashless while allowing governments to maintain regularity control over monetary policy.

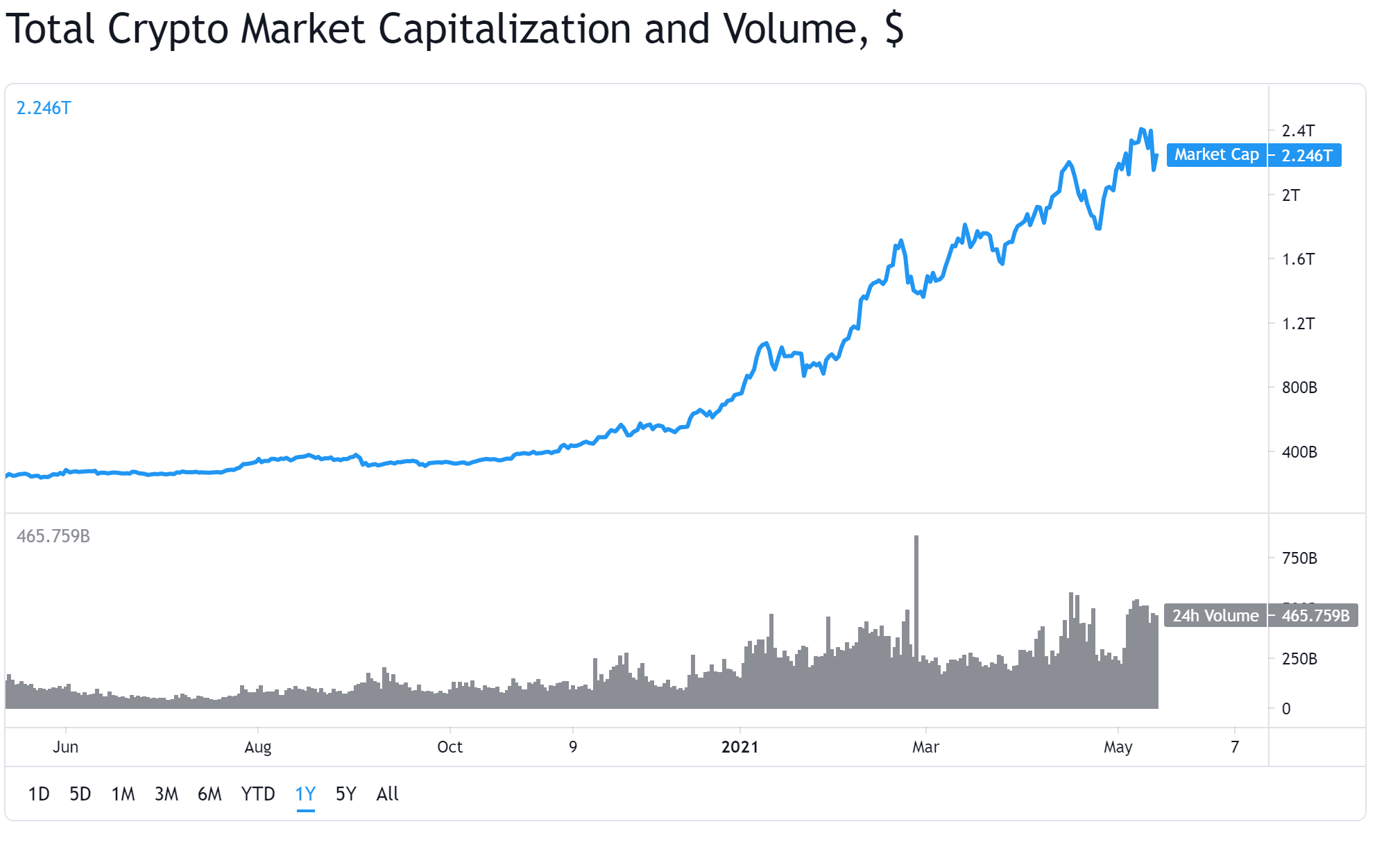

There doesn’t seem to be any stopping funds flowing into cryptocurrency. According to data from CoinShares, investors have poured over $4.2 billion into crypto during the first quarters of 2021, smashing the previous high of $3.9 billion set in the fourth quarter of last year.

Record inflows and massive price movements have pushed the cryptocurrency market to a new all-time high, topping $2.24 trillion. But despite the surging value of many other cryptocurrencies, Bitcoin remains on top. With a market cap approaching $1 trillion, BTC represents nearly half of the entire cryptocurrency market.

Source:TradingView

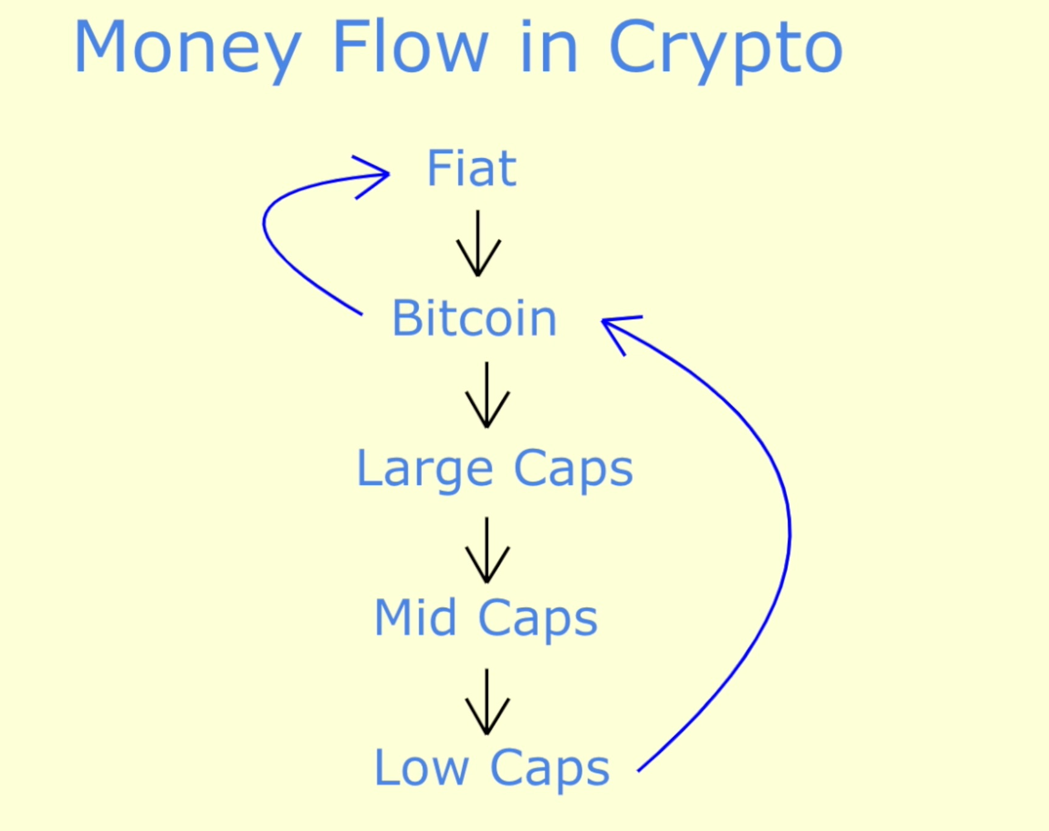

Profiting from cryptocurrency requires an understanding of how and why money flows into and out of digital coins.

Source: hackernoon

Fiat

A cryptocurrency investment needs to start somewhere, and that somewhere is with fiat. The currency doesn’t matter – US dollar, the Euro, or the Yen – fiat currency is needed to make a cryptocurrency investment. While digital coins may be the future, you can’t buy them without fiat.

Bitcoin

Since BTC currently captures closes to 50% of the total cryptocurrency market, we will assume most investors will choose to hold this crypto in their portfolios. As more investors enter the market and presumably buy Bitcoin, the price of Bitcoin will rise.

Other Large Caps

As the price of Bitcoin continues to record new highs, a significant BTC investment out of reach for many investors. Investors looking to diversify and increase their return will often look towards other large-cap Altcoins like Ethereum.

Mid-Cap Altcoins

Altcoins are all cryptocurrencies other than Bitcoin. Since many of these lesser-known coins are built on Ethereum, the price of Ether is often viewed as a leading indicator of what will happen in the broader Altcoin market. When ETC appreciates, other Altcoins typically follow suit, driving investors to diversify their portfolios with more mid-cap Altcoins.

Small-Cap Altcoins

At the end of the Crypto Money Flow Cycle are small-cap altcoins. These high-risk, high-reward coins tend to rally at the end of the Crypto Money Flow Cycle when profit-seeking investors look towards new, riskier avenues of securing more significant returns.

Back to Bitcoin or Selling into Fiat

After a small-cap altcoin rally, investors looking to secure their gains typically take one of two actions: they move their profits back into Bitcoin or cash out for fiat.

Movement back into Bitcoin fuels the Crypto Money Flow Cycle starting at BTC and working its way down to small-cap altcoins again.

Investors choosing to secure their gains can cash out in the form of fiat. If cash outflows surpass cash inflows, there could be a corrective period in crypto prices that ultimately attracts new investors, beginning the Crypto Money Flow Cycle once again.

Blockchain Foundry Inc., a Canadian publicly listed company focused on the blockchain and cryptocurrency industries, is at the forefront of developing blockchain solutions for the finance sector.

While Blockchain Foundry Inc. has a focus on developing Blockchain assets like NFTs and DeFi applications, the company is also engaged in Blockchain development initiatives along several verticals for large enterprises.

In 2020, Blockchain Foundry Inc. announced it had entered into a Blockchain development agreement with a large Canadian financial institution and more recently released a press release outlining its current strategy.

“BCF has been actively evaluating blockchain-enabled product opportunities in several industry verticals, including remittances, loyalty applications and digital identities.”

The company then went on to say it “has recently engaged in two solution design projects, one for a carbon exchange product using a digital asset to represent sequestered carbon, and another project building an NFT platform to track the popularity of music, movies and TV shows and produce a corresponding payout.”

With recent cryptocurrency prices facing greater volatility, readers should learn if the sector is near bottom.

Disclaimer: The company described in this article is a customer of NAI Interactive Ltd. This material is for informational purposes only and is not intended as a recommendation or offer or solicitation for the purchase or sale of any securities or financial instruments, or for transactions involving any financial instrument or trading strategy.