Global Cannabis Applications Corp. (CSE:APP)

GCAC develops technologies that benefit the medical cannabis ecosystem by helping cultivators control and optimize product lifecycle to improve the consumer experience and create better patient outcomes.

There’s another new token trading on Uniswap.

Global Cannabis Applications Corp. (CSE: APP) (FSE: 2FA) (OTCQB: FUAPF) cleverly announced the launch of the newly minted GCAC Uniswap marketing token (GCAC) on 04/20 – the unofficial globally celebrated cannabis holiday – as a part of a digital marketing campaign strategy aimed to increase brand awareness.

GCAC is a leading medical cannabis chain of custody and data platform. Their Efixii or “QR code” technology helps cannabis users to accurately track every step in each gram of cannabis products from production to consumption. The result is a data set that has never existed at this level before in the cannabis industry.

As a company’s whole business that is based on the utilization of the immutable Ethereum blockchain, GCAC has jumped on board with the up-and-coming idea of Cross-Fi (cross-market finance), Cross-Fi provides GCAC, a highly regulated public entity, with the benefits of decentralized finance.

A buy-back contract feature in GCAC’s Uniswap-inclusion marketing initiative provides a commitment to spend 1% of quarterly revenues buying GCAC tokens on Uniswap. This allows investors to gain exposure to GCAC performance but through the Uniswap platform.

The launch of GCAC’s Uniswap marketing token will provide the company with significant exposure in the burgeoning crypto market, a market that also embraces cannabis.

Uniswap is a decentralized crypto exchange (DEX) running on the Ethereum blockchain used to swap any ERC20-based tokens.

Unlike other crypto exchanges, which operate like traditional stock exchanges by maintaining order books matching buyers and sellers to determine price and execute trades, Uniswap is entirely decentralized.

Envisioned as a way to facilitate community token trades without excessive platform fees or intermediaries, Uniswap instead uses paired liquidity pools and a simple math equation to process token swaps.

This “Constant Product Market Maker Model” run by an automated market maker algorithm (AMM) ensures that all token swaps get executed. There is constant liquidity no matter the size of the order. No bids, no offers; token price is determined by the equation x*y=k, where x and y are tokens and k is a constant. The price of a coin increases or decreases based on the token ratio in a respective liquidity pool.

Because of its decentralized structure, Uniswap is also one of the few exchanges that does not require users to give up control of their private keys to log orders, meaning traders always maintain control of their crypto assets.

Another unique feature about Uniswap is that anyone can add a token by funding it with an amount of ETH and the ERC20 token being traded. There are no fees for listing a new token on Uniswap, unlike excessive listing fees associated with profit-driven centralized exchanges.

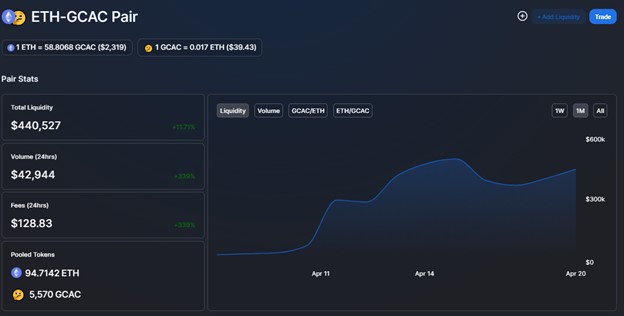

A cryptocurrency pair combines two crypto assets, like tokens or coins, that can be traded for each other on a crypto exchange. In Uniswap’s case, each crypto pair represents a different liquidity pool. Pairs can be represented by a dash (—) or a slash (/). In this example, ETH-GCAC is a liquidity pool for those looking to buy GCAC with ETH or sell GCAC to get ETH.

ETH-GCAC pair price

To stand out, publicly traded companies need to continuously develop innovative investor relation plans to attract attention in an increasingly competitive space.

With its Uniswap marketing token, GCAC stands to benefit from exposure in a rapidly growing market; namely the 30-or-so-year-olds with disposable income trading in crypto assets, particularly those searching for so-called hidden gems not yet available on major centralized exchanges like Coinbase and Kraken.

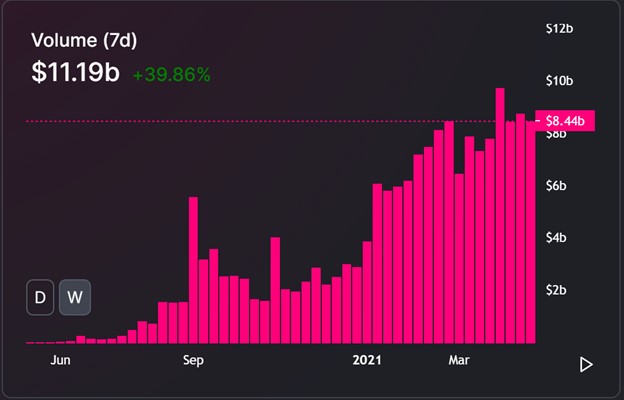

And GCAC chose the right timing for launching the new token with Uniswap. Trade volume on the DEX platform hit a new high, crossing the $10 billion threshold for the first time this past week, capitalizing on the ongoing decentralized finance boom.

Since Uniswap CEO Hayden Adams tweeted the breakthrough news on Tuesday, Uniswap has continued to climb, posting a 39% weekly increase in volume. If Uniswap can maintain the current momentum, it could process over $500 billion in a year.

Source: Uniswap

Mega-cap companies like Tesla (TSLA) have been diversifying their balance sheets by adding crypto to their books. By adding Ether-based GCAC marketing tokens to their balance sheet through their 1% buy-back program, GCAC is not only demonstrating its ability to use innovative tools to increase awareness of its products, but also positions itself among the next generation of companies embracing alternative assets.

About Global Cannabis Applications Corp. “GCAC”

GCAC is a global leader in designing and developing innovative software solutions serving the medical cannabis industry. Its Citizen Green and Efixii platforms provide the world’s first end-to-end medical cannabis data solutions, allowing patients to see the entire chain-of-custody history of the cannabis products they purchase from seed to sale.

The software is based on six core technologies: mobile applications, artificial intelligence, RegTech, smart databases, Ethereum blockchain and GCAC smart rewards. Driven by digital and cannabis industry experts, GCAC focuses on generating revenue from SaaS (software as a service), licensing its technology and acquiring high-quality cannabis datasets that improve patient outcomes. As a pioneer in this emerging field, GCAC looks to become the world’s largest cannabis efficacy data provider.