TORONTO, Aug. 16, 2021 /PRNewswire/ – DeFi Technologies Inc. (the “Company” or “DeFi Technologies“) (NEO: DEFI) (GR: RMJR) (OTC: DEFTF) announces its strong financial performance for the three and six-month period ending June 30, 2021 since inception (all amounts in Canadian dollars, unless otherwise indicated).

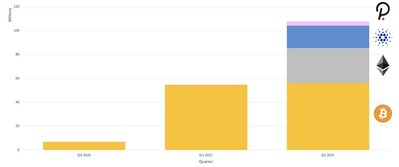

Valour AUM (CNW Group/DeFi Technologies, Inc.)

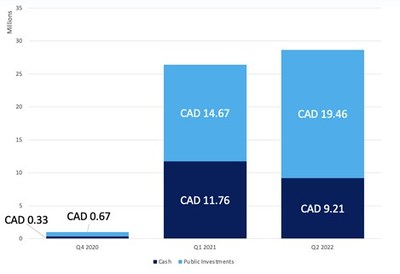

Cash and Public Investments (CNW Group/DeFi Technologies, Inc.)

In Q2 2021 the Company achieved a record of $107M in assets under management (“AUM“) in fully owned subsidiary Valour Inc. (“Valour“) which is responsible for the Company’s portfolio of products of exchange-traded notes (“ETNs“). In Q2 2021, Valour added two new ETNs to the product mix: Polkadot and Cardano – and plan to launch other innovative ETN’s in the very near future. Both are available on the Nordic Growth Market in Sweden (“NGM“). With Bitcoin experiencing volatility especially around May 19, 2021, the Company has seen the product mix of their ETNs diversify with about 50% held in Bitcoin and 50% in Ethereum (launched late in Q1 2021), while the AUM of Polkadot, and Cardano ETN’s continue to grow.

“Despite the volatility experienced in the broad-based weakness in the crypto and decentralized finance markets around May 2021, we have seen strong demand and inflows into our Valour business, which is really promising. Diana and the team have done an excellent job attracting new investors into these products and the tech and trading team in Zug have shown that even in high volume days our infrastructure and processes are up to the task.”, said Wouter Witvoet, Chief Executive Officer of DeFi Technologies.

ETNs / Valour

The Company is pleased to announce that its ETN business Valour has grown its AUM to $107M in AUM at the end of Q2 2021. The total revenue derived from the Valour business was $2,586,742 for the quarter, implying a potential $10.3M in annualized recurring revenue off of Valour’s relatively small but growing asset base.

Liquidity

The Company maintains a very strong liquidity position. Cash and liquid assets at the end of Q2 2021 stand at CA$28.67M, with an additional $0.9m in crypto investments. With recent increases in share prices of some of its public investments, this value is expected to be significantly higher in the coming months provided that such public investments maintain or increase their value.

|

DEFI – in CAD millions |

6 months ended |

|

June 30, 2021 |

|

|

Balance Sheet |

|

|

Cash |

9.2 |

|

Public Investments |

19.5 |

|

Crypto holdings |

0.9 |

|

29.6 |

|

|

Private company investments |

10.6 |

|

Locked in Crypto |

0.1 |

|

10.7 |

|

|

Total current and futures available assets (June 30) |

40.3 |

|

Total current and futures available assets (Current) |

45.8 |

Financial performance

The Company have total revenue of $(1.9)M for the three months ended June 30, 2021. Backing out the mark to market loss on the Company’s equity positions of $(2.3)M, including the unrealized loss of $1.8M on HIVE Blockchain Technologies investment, the Company had total revenues of $0.4M in a weak cryptocurrencies market period.

|

Revenues – in CAD millions |

3 months ended |

|

|

June 30, 2021 |

||

|

ETP trading |

$ |

2,504,214 |

|

Other trading income |

$ |

16,572 |

|

Lending income |

$ |

65,956 |

|

Realized (loss) on digital assets |

$ |

(3,950,265) |

|

Unrealized (loss) on digital assets |

$ |

(48,119,403) |

|

Unrealized gain on ETP holders |

$ |

49,823,748 |

|

Realized gain (loss) on investments, net |

$ |

10,073 |

|

Unrealized (loss) gain on investments, net |

$ |

(2,274,452) |

|

Interest income |

$ |

3,130 |

|

Total revenue |

$ |

(1,920,427) |

|

less Unrealized (loss) gain on investments, net |

$ |

2,274,452 |

|

Adjusted revenue (non-IFRS) |

$ |

354,025 |

The total corporate loss of the period ending June 30, 2021, was CA$2.7M. There were also intangible losses such as acquisition loss costs (Valour) and change in token prices (Bermuda) loss as well as option issuances to core employees and contractors.

|

DEFI – in CAD millions |

3 months ended |

6 months ended |

|

June 30, 2021 (C$) |

June 30, 2021 (C$) |

|

|

Reported Net Loss |

-12.2 |

-19 |

|

Less: |

||

|

DeFi Holdings transactions costs |

0 |

6 |

|

Amortization of intangibles |

1 |

1.2 |

|

Share-based compensation |

6.3 |

8.3 |

|

Adjusted Net loss: |

-4.9 |

-3.5 |

Notes and Commentary

Wouter Witvoet, DeFi Technologies Chief Executive Officer stated: “For a company that is experiencing our type of double digit growth and with the investments and expenditures we have made, it is a great result to see such a small loss in the period and shows that we remain exceptionally well capitalized. Such a strong liquidity position will allow us to keep growing our business for the many periods to come. With our proposed acquisitions of DeFi Yield and Protos we now have a ‘triangle’ in place that caters to all relevant investor groups we have identified: public market investors, institutional private investors, and crypto-native investors.”

About DeFi Technologies:

DeFi Technologies Inc. is a Canadian company that carries on business with the objective of enhancing shareholder value through building and managing assets in the decentralized finance sector. For more information visit https://defi.tech/

Cautionary note regarding forward-looking information:

This press release contains “forward-looking information” within the meaning of applicable Canadian securities legislation. Forward-looking information includes, but is not limited to, statements with respect to the financial performance of the Company; the financial statements of the Company and valuation of investments; anticipated revenues, acquisition and investment plans of the Company; the decentralized finance industry and the merits or potential returns of any such opportunities. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “plans”, “expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur” or “be achieved”. Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company, as the case may be, to be materially different from those expressed or implied by such forward-looking information. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information. The Company does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

Non-IFRS Measures

The Company believes that Adjusted Revenue is an important measure when analyzing its financial performance without being influenced by quarterly adjustments of public investments and ordinary course hedging operations of its subsidiaries. The Company also believes that Adjusted Net Loss is an important measure as it as it shows the losses of the Company without incorporating certain one time acquisition costs, share-based compensation and amortization of intangible assets. These non-IFRS financial measures are not earnings or cash flow measure recognized by International Financial Reporting Standards (“IFRS”) and do not have a standardized meaning prescribed by IFRS. The Company’s method of calculating Adjusted Revenue and Adjusted Net Lost may differ from the methods used by other issuers and, accordingly, the definition of these non-IFRS financial measure may not be comparable to similar measures presented by other issuers. Investors are cautioned that non-IFRS financial measures should not be construed as an alternative to revenue or net income/loss determined in accordance with IFRS as indicators of the Company’s performance or to cash flows from operating activities as measures of liquidity and cash flows.

THE NEO STOCK EXCHANGE DOES NOT ACCEPT RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.