1,450 g/t Silver Equivalent* over 3 m in 1.5 km district step-out near Ruby

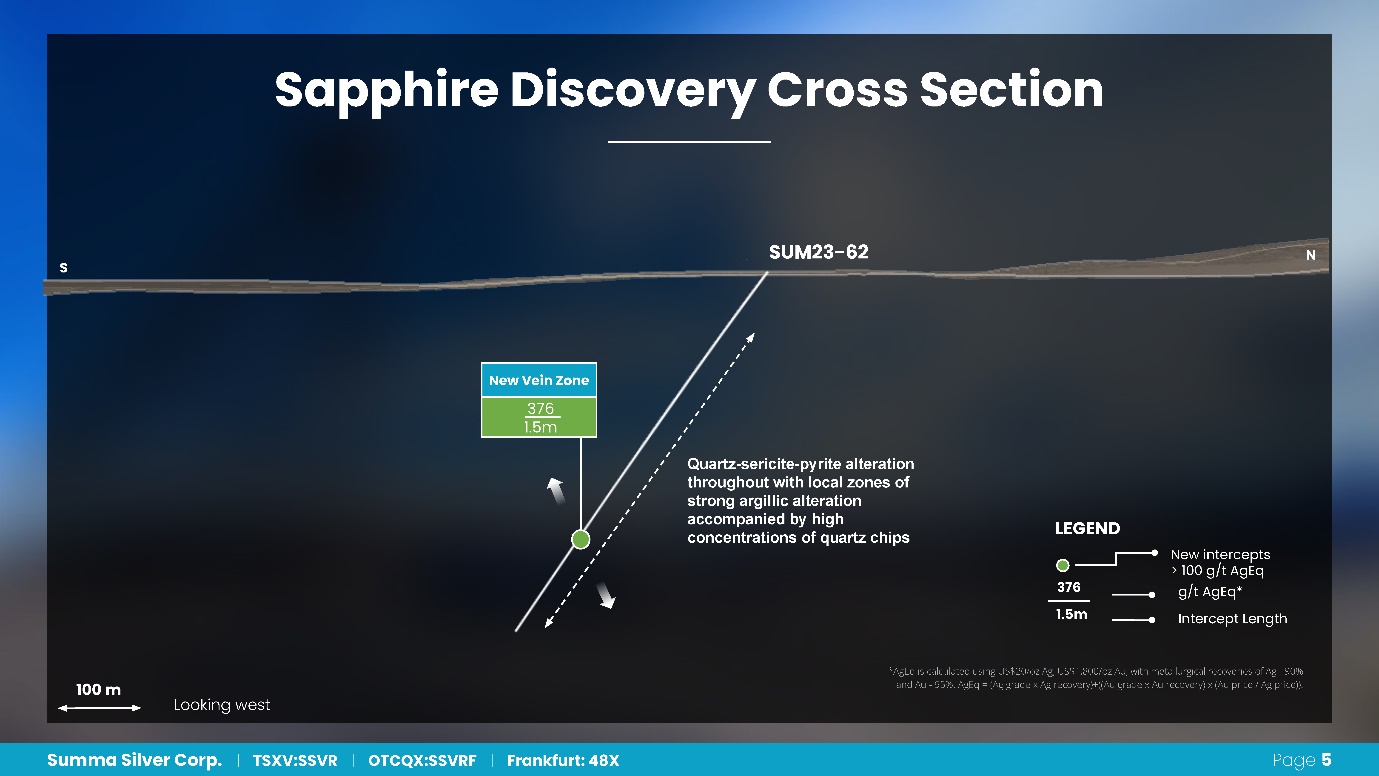

376 g/t Silver Equivalent* over 1.5 m in 4.2 km district step-out at Sapphire

Vancouver, August 2, 2023 – Summa Silver Corp. (“Summa” or the “Company”) (TSXV:SSVR) (OTCQX:SSVRF) (Frankfurt:48X) is pleased to announce that it has discovered two new high-grade silver-gold veins in wildcat-style exploration holes at the Hughes Project near Tonopah, Nevada (the “Hughes Project”).

Ruby Discovery:

Sapphire Discovery:

Other Key Highlights:

* Silver equivalent is calculated using US$20/oz Ag, US$1,800/oz Au with metallurgical recoveries of Ag – 90%, Au – 95%. AgEq = (Ag grade x Ag recovery)+((Au grade x Au recovery) x (Au price / Ag price)).

Galen McNamara, CEO, stated: “The new discoveries across the eastern extension of the Tonopah mining district are a testament to our systematic and methodical approach to exploration. From the beginning we have strongly believed the productive veins of Tonopah continued to the east under cover. Results from our exploration drilling to-date so far support that hypothesis and confirm the significant big picture prospectivity of the Hughes Project. The Company continues to be well financed and remains in the strong position of having two American high-grade, district-scale silver projects, both of which continuously show strong zones of mineralization hole after hole.”

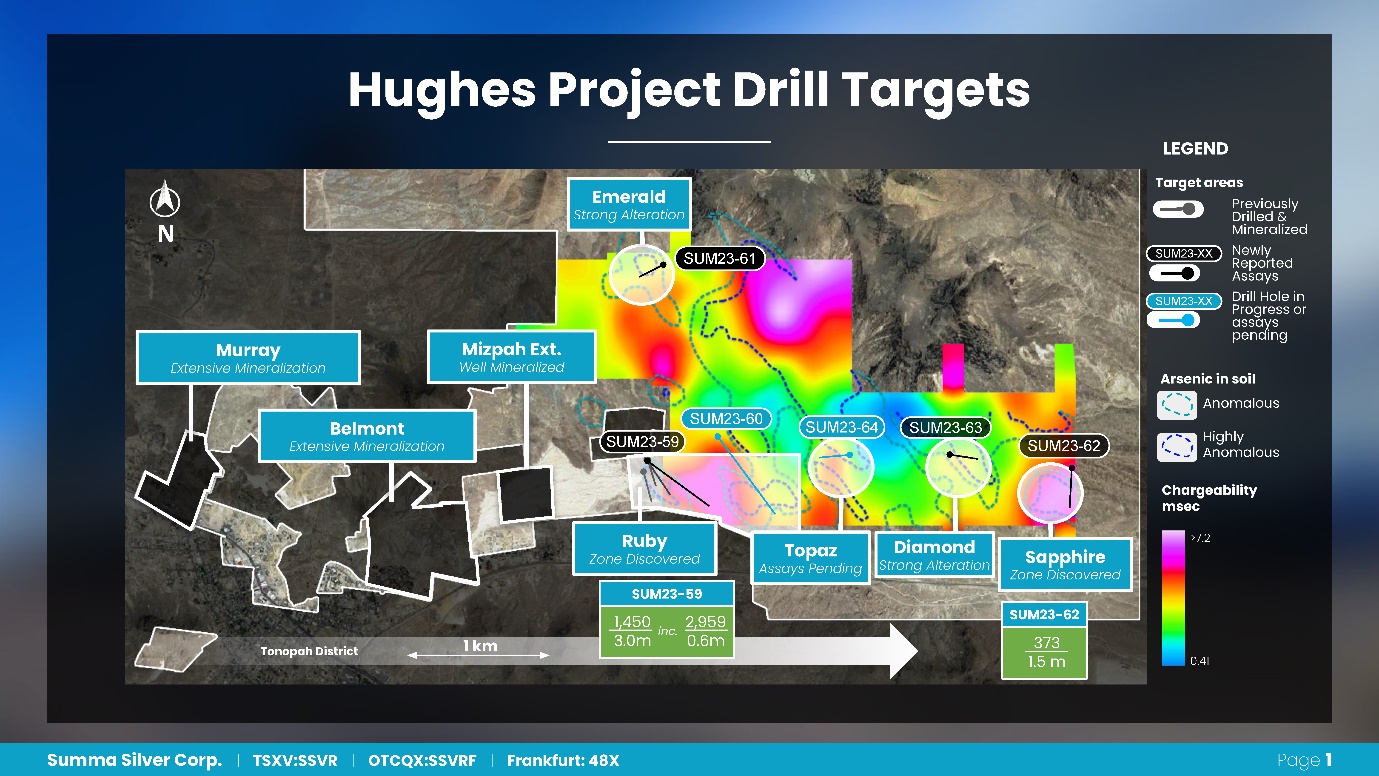

Figure 1: Hughes Project Drill Targets

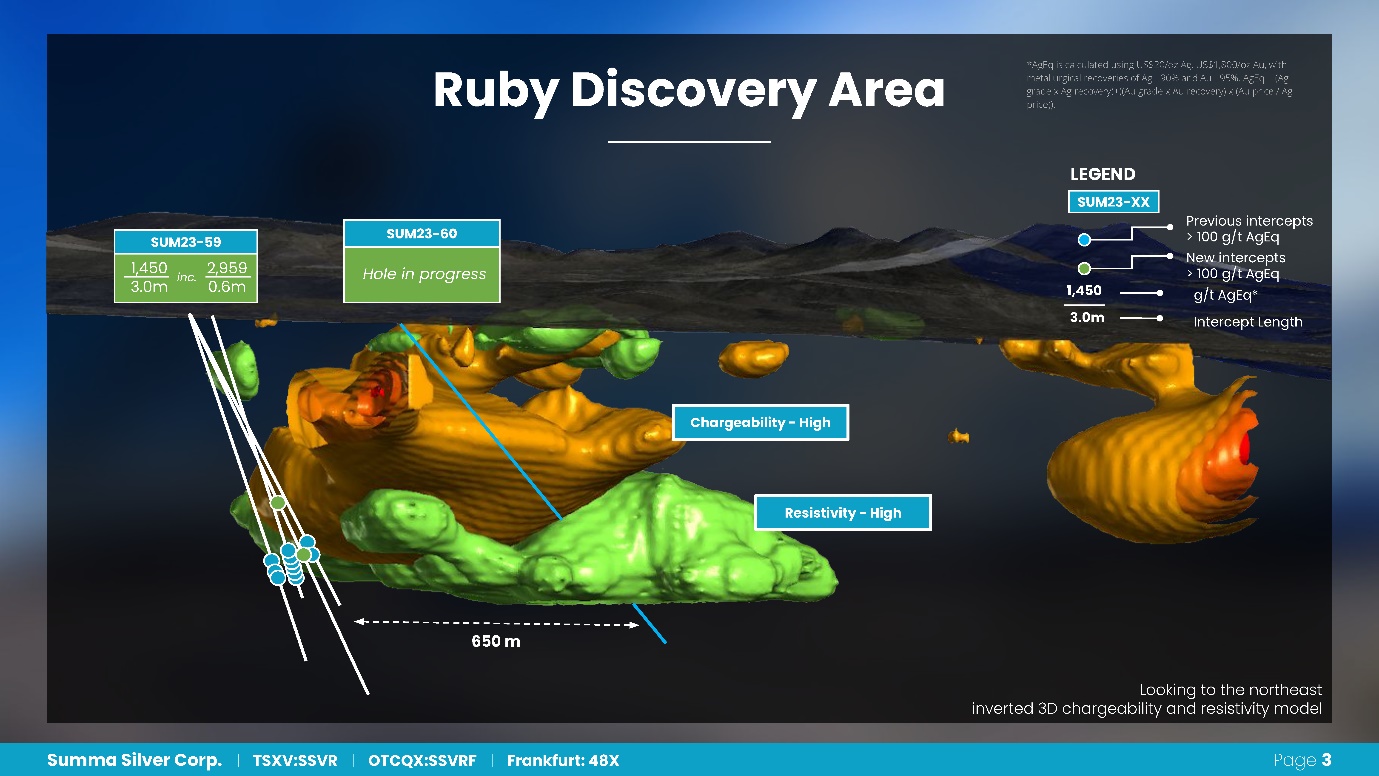

Figure 2: Ruby Discovery Hole Locations and Targets

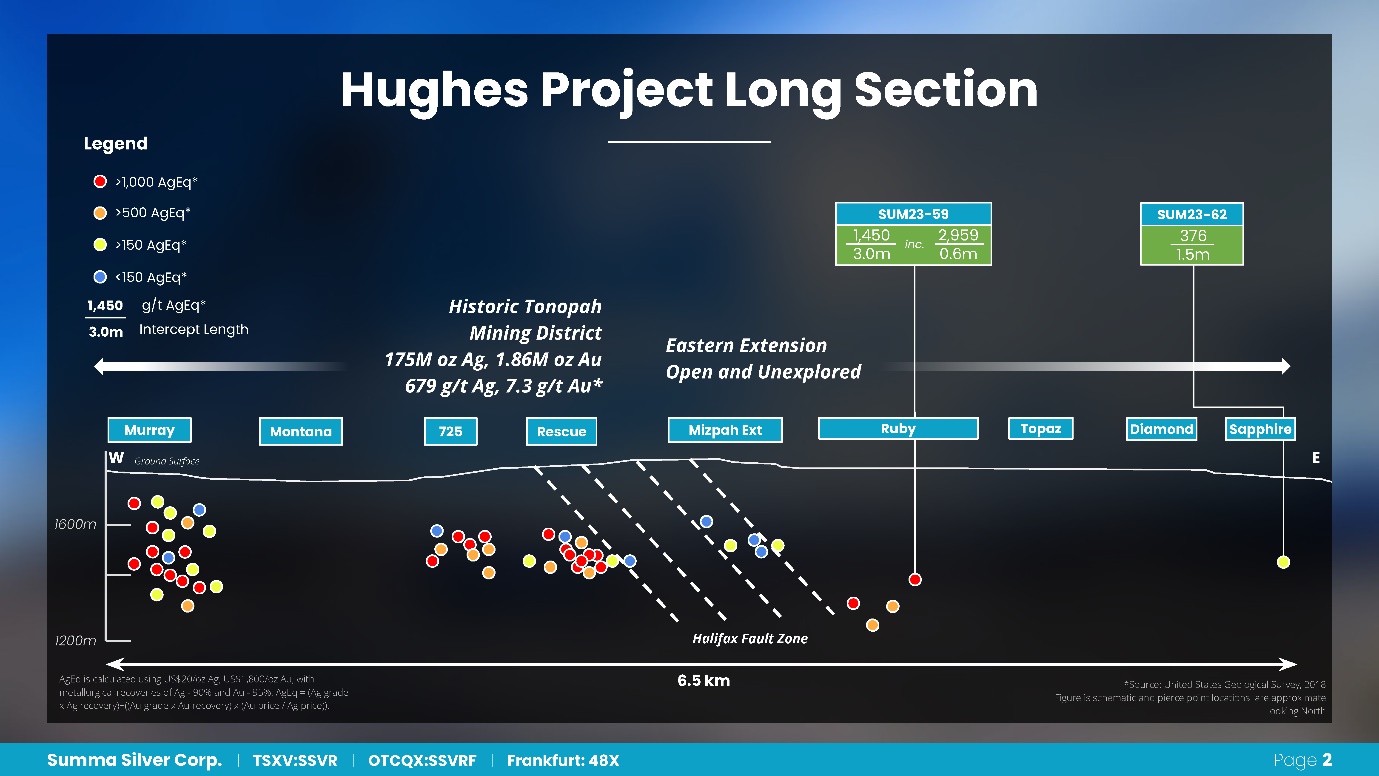

Figure 3: Hughes Project Long Section

Drill Program

Results are reported here for 2,214 m of drilling in both RC and core configurations across four epithermal vein targets, all located outside the historic Tonopah mining district (Figures 1 and 2). The purpose of the reconnaissance-style drill program was to test for epithermal-related veins along trend to the east from the Ruby discovery and to define the eastern extension of the district. One additional hole was lost and abandoned at a depth of 230 m at the Ruby target due to poor ground conditions in a fault zone. The final planned hole of the program is in progress and assays for another remain pending.

Table 1: Assay Results

| Drill Hole | From (m) | To (m) | Length (m) | Au (g/t) | Ag (g/t) | AgEq* (g/t) |

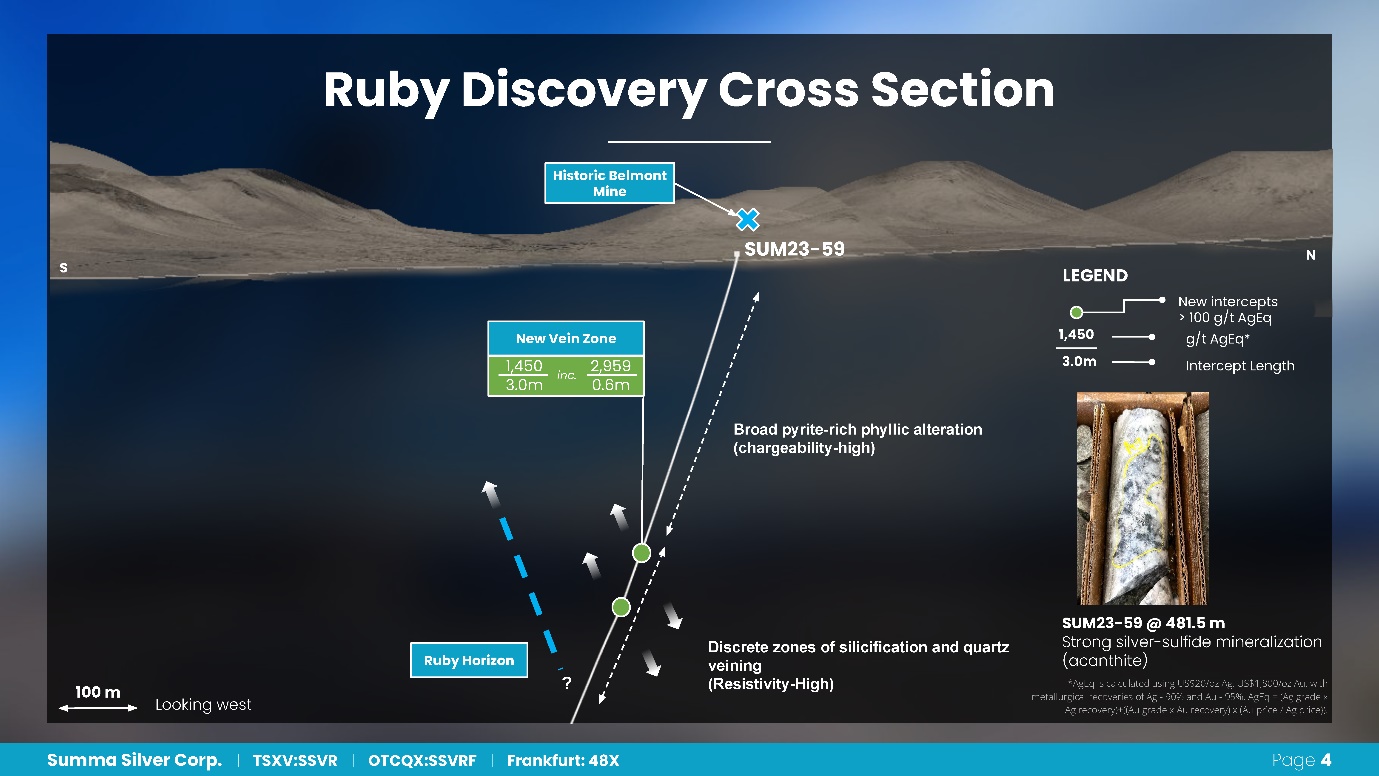

| SUM23-59 | 480.8 | 483.7 | 3.0 | 8.40 | 813 | 1,450 |

| incl. | 483.1 | 483.7 | 0.6 | 17.4 | 1,635 | 2,959 |

| and | 566.1 | 569.3 | 3.1 | 0.7 | 68 | 188 |

| incl. | 566.1 | 566.9 | 0.7 | 1.43 | 162 | 268 |

| SUM23-60 | Drilling in Progress | |||||

| SUM23-61 | No Mineralized Intersections – Strong Hydrothermal Alteration | |||||

| SUM23-62 | 413.0 | 414.5 | 1.5 | 2.56 | 175 | 376 |

| SUM23-63 | No Mineralized Intersections – Strong Hydrothermal Alteration | |||||

| SUM23-64 | Assays Pending | |||||

* Silver equivalent is calculated using US$20/oz Ag, US$1,800/oz Au with metallurgical recoveries of Ag – 90%, Au – 95%. AgEq = (Ag grade x Ag recovery)+((Au grade x Au recovery) x (Au price / Ag price)).

Table 2: Collar Information

| Target Area | Drill Hole | Type | Easting | Northing | Azimuth | Dip | Final Depth |

| Ruby | SUM23-59 | Core | 482537 | 4214094 | 112 | -67 | 903 |

| Emerald | SUM23-61 | RC | 482671 | 4215535 | 260 | -70 | 366 |

| Sapphire | SUM23-62 | RC | 485514 | 4214077 | 180 | -55 | 549 |

| Diamond | SUM23-63 | RC | 484655 | 4214091 | 90 | -55 | 396 |

The primary targets were identified by Summa over the course of multiple ground-based exploration programs (see the Company’s news release dated May 2, 2023), and include:

Drilling is ongoing on hole SUM23-60 representing a 650 m eastern step out from hole SUM23-59. The hole is further testing the eastern strike-extent of the Ruby veins. Results from this hole and hole SUM23-64 will be released once results are received from the lab.

Figure 4: Ruby Discovery Cross Section

Figure 5: Sapphire Discovery Cross Section

Analytical and QA/QC Procedures

Drill core and RC chip samples were sent to Paragon Geochemical Laboratories in Sparks, Nevada for preparation and analysis. Paragon meets all requirements of the International Accreditation Service AC89 and demonstrates compliance with ISO/IEC Standard 17025:2017 for analytical procedures. Samples were analyzed for gold via fire assay with an AA finish (“Au-AA30”) and samples that assayed over 8 ppm were re-run via fire assay with a gravimetric finish (“Au-GR30”). Silver, and trace elements were analyzed via inductively coupled plasma mass spectroscopy after four-acid digestion (“49MA-MS”). Samples that assayed over 100 ppm Ag were re-run via fire assay for Ag with a gravimetric finish (“Ag-GR30”). In addition to Paragon quality assurance / quality control (“QA/QC”) protocols, Summa implements an internal QA/QC program that includes the insertion of sample blanks, duplicates and certified reference materials at systematic and random points in the sample stream.

Qualified Person

The technical content of this news release has been reviewed and approved by Galen McNamara, P. Geo., the CEO of the Company and a qualified person as defined by National Instrument 43-101.

About Summa Silver Corp

Summa Silver Corp is a junior mineral exploration company. The Company owns a 100% interest in the Hughes project located in central Nevada and has an option to earn 100% interest in the Mogollon project located in southwestern New Mexico. The high-grade past-producing Belmont Mine, one of the most prolific silver producers in the United States between 1903 and 1929, is located on the Hughes project. The Mogollon project is the largest historic silver producer in New Mexico. Both projects have remained inactive since commercial production ceased and neither have seen modern exploration prior to the Company’s involvement.

Follow Summa Silver on Twitter: @summasilver

LinkedIn: https://www.linkedin.com/company/summa-silver-corp/

Website: https://www.summasilver.com

ON BEHALF OF THE BOARD OF DIRECTORS

“Galen McNamara”

Galen McNamara, Chief Executive Officer

[email protected]

www.summasilver.com

Investor Relations Contact:

Giordy Belfiore

Corporate Development and Investor Relations

604-288-8004

[email protected]

www.summasilver.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary note regarding forward-looking statements

This news release contains certain “forward looking statements” and certain “forward-looking information” as defined under applicable Canadian and U.S. securities laws. Forward-looking statements and information can generally be identified by the use of forward-looking terminology such as “may”, “will”, “should”, “expect”, “intend”, “estimate”, “anticipate”, “believe”, “continue”, “plans” or similar terminology. The forward-looking information contained herein is provided for the purpose of assisting readers in understanding management’s current expectations and plans relating to the future. These forward‐looking statements or information relate to, among other things: exploration and development of the Company’s mineral exploration projects including completion of surveys and drilling activities; the release of assays.

Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual actions, events or results to be materially different from those expressed or implied by such forward-looking information, including but not limited to: the requirement for regulatory approvals; enhanced uncertainty in global financial markets as a result of the current COVID-19 pandemic; unquantifiable risks related to government actions and interventions; stock market volatility; regulatory restrictions; the ongoing conflict in Ukraine; and other related risks and uncertainties disclosed in the Company’s public disclosure documents.

Forward-looking information are based on management of the parties’ reasonable assumptions, estimates, expectations, analyses and opinions, which are based on such management’s experience and perception of trends, current conditions and expected developments, and other factors that management believes are relevant and reasonable in the circumstances, but which may prove to be incorrect.

The Company undertakes no obligation to update forward-looking information except as required by applicable law. Such forward-looking information represents management’s best judgment based on information currently available. No forward-looking statement can be guaranteed and actual future results may vary materially. Accordingly, readers are advised not to place undue reliance on forward-looking statements or information.