U.S. oil output could be set for a last spike in 2018 before growth flattens for a number of years as rising costs make a big chunk of production uneconomic, the head of top oil trader Vitol, Ian Taylor, told Reuters.

The United States has turned into a major oil exporter in recent years on the back of a shale revolution, which created a global oil glut and sent prices plunging to below $30 per barrel last year from as high as $110 in 2014.

“I think the question, a little bit in the longer term is – is this the last big rise in U.S. production?” said Taylor, chief executive at Vitol, which trades more than 7 percent of global oil and has a large presence in U.S. markets.

He said Vitol expected U.S. output to climb by 0.5-0.6 million barrels per day (bpd) next year but the increase would cause cost inflation and make some production loss-making.

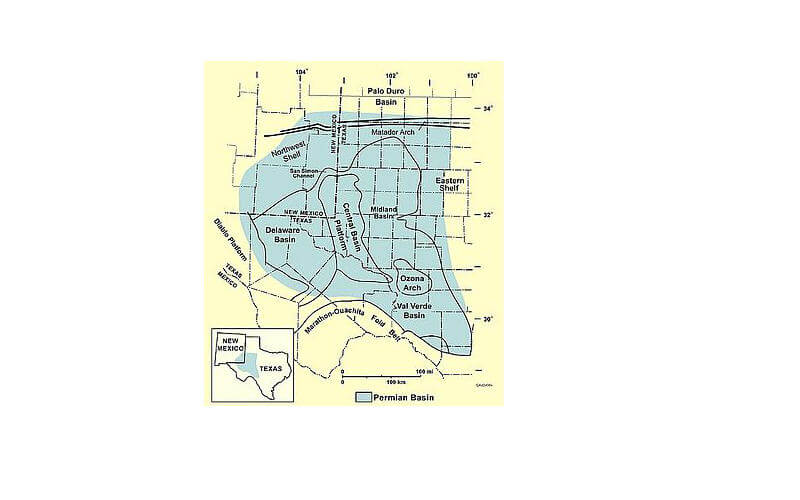

“If you look at the economics on most of the big Permian players, not many of them make a lot of money,” Taylor said, referring to the oil-rich Permian basin in the United States.

The anticipated slowdown in U.S. output combined with robust growth in global demand for oil should push prices above the current range of $50-60 per barrel, Taylor said.

But in the short and medium term, the oil market will remain “boringly rangebound” with prices possibly coming under downward pressure in the first few months of 2018, when demand would typically weaken.

“The market is tightening up. But it’s very shallow … There will be moments when we must get closer to $60 and moments I‘m sure when we’ll flirt with a number with a 4 in front of it. But it’s a pretty narrow range,” Taylor said.

Vitol has sold most of its oil in storage as it believes the market is tightening, supported by robust demand growth of around 1.5-1.6 million bpd this year and next as well as a paucity of investments by oil majors in new projects.

Taylor said Vitol was trading larger volumes than in 2016, when it shifted around 7 million bpd of oil and products, while margins this year were down.

“The prices haven’t moved, the disconnects aren’t really there, so it’s a tougher business … We traders don’t like instant volatility. We’re very useless at that. We do like to see a trend for more than a nanosecond.”

“We’re doing a bit more volume for a little less return … It’s not rocket science, but margins are very, very tight. Extremely tight,” he said.

Source: Reuters