AXMIN Inc (TSXV: AXM)

AXMIN Inc. (TSXV:AXM) is a Canadian-based exploration and development company with a strong focus on central and West Africa.

Morgan Stanley is optimistic about commodities, especially precious metals. Gold and silver are the only structural bullish commodities for the bank for the second consecutive year. In January 2024, Morgan Stanley released a gold price outlook, predicting a potential rise to $2500 per ounce this year. The basis for this forecast is the anticipated favorable impact of the interest rate cut cycle on precious metals, supporting an increase in prices in the latter half of the year.

While Morgan Stanley mentioned geopolitical risks and the downside risk of the US dollar, it is evident that the core logic behind the bank’s bullish view on gold is the monetary policy of the Federal Reserve. Therefore, let’s first discuss the relationship between gold and interest rates.

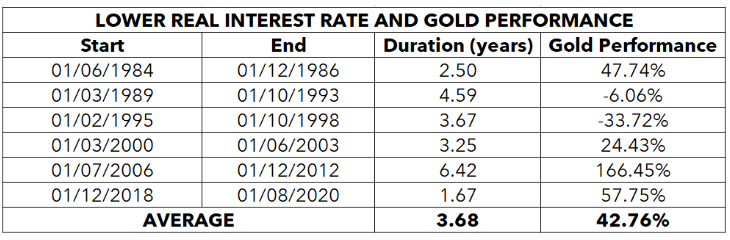

Historical data shows that in the periods before and after the previous three interest rate cut cycles (2001, 2007, and 2019), the trend in gold prices has been upward, with yields ranging between 20% to 30%. During periods of declining real interest rates in the US (with an average duration of 3.68 years), the gold price has shown more gains than losses. The average yield exceeded 42%, with an annualized average yield of over 10%, almost double the average annual yield.

According to the above information, a 20% to 30% increase in gold prices would reach a range between $2500 and $2700. If there is a 40% increase over four years, the target price for gold in 2027/2028 would be close to $3000. However, this is purely theoretical and lacks support from fundamentals and historical precedents.

There is a concept of 8-year and 16-year cycles in the gold market. According to the 8-year cycle, after reaching a peak in 2020, gold prices have recently bottomed out in the last few months, while the 16-year cycle is currently in the intermediate stage. Typically, the peak of the 16-year cycle occurs in the 12th year, which would be 2027/2028.

Gold prices have two major support levels, with the second support level near $1700, which is both a profitability threshold for many mining companies and a strong technical threshold. This support level has been tested five times between 2020 and 2024. Conversely, the range of $2070-2080 is a glass ceiling, having failed four tests. However, the consolidation range formed as a result of this is about to be thoroughly broken, with the long-term target price for gold estimated to be at a maximum of $2600 (+23%).

Another important indicator is the correlation of gold prices with other markets. Over the past 6 months (from September 2023 to March 2024), the correlation between gold and Bitcoin has been as high as 80%, significantly higher than the correlations with silver (55%) and the MSCI World stock index (60%). This indicates that the recent rise in gold prices is indeed driven by monetary policy factors.

Data from the World Gold Council (WGC) shows that gold production remained stable at 3644 tons in 2023, with the supply of recycled gold increasing by nearly 10%. Notably, the substantial demand from central banks remained stable (-4%), while the gold purchasing volume of 2023 was more than double the normal level, but investment demand decreased significantly (-15%). Therefore, on the basis of strong sovereign gold demand, once investment demand is stimulated, gold prices will rise further.

Now, let’s talk about the “fundamental price” of the long-term gold market, which is the production cost of gold. In the third quarter of 2023, the average production cost of one ounce of gold was estimated at $1315, a slight increase from before. Risks may lead to further increases in input costs, affecting the adjusted operating costs and all-in sustaining costs (AISC) for gold producers, indicating that gold prices are unlikely to remain below $2000 for an extended period.