Newrange Gold Corp. (TSXV: NRG, OTC: NRGOF)

“Where Exploration INTERSECTS Discovery”

There are few certainties in the stock market; however, when inflation starts heating up, people tend to flock to gold – and that’s exactly what we are seeing happen right now.

The gold market has entered bullish territory again, and investors should be paying particular attention to gold stocks.

As pandemic fears subside and vaccination programs well underway, the global economy appears primed for recovery. But with most governments continuing unprecedented stimulus spending and central banks maintaining loose monetary policies, gold prices and gold stocks could be primed for takeoff.

Some analysts are predicting that gold stocks could see potential gains over 10X during what is expected to be a years-long bull cycle – and here’s why.

Gold prices have already gained over 12% from March lows. May alone saw prices increase nearly 8%, making it the best month for gold since July 2020, and if this latest bull run follows a similar trajectory of past runs, we could just be getting started.

This uptrend in gold prices is an optimistic sign for gold stocks because generally, gold stocks follow gold prices in moving opposite the market, which is one of the main reasons people buy gold during times of market volatility.

However, unlike physical gold, gold stocks are an investment in a company, and with that comes the added opportunity to benefit from their success.

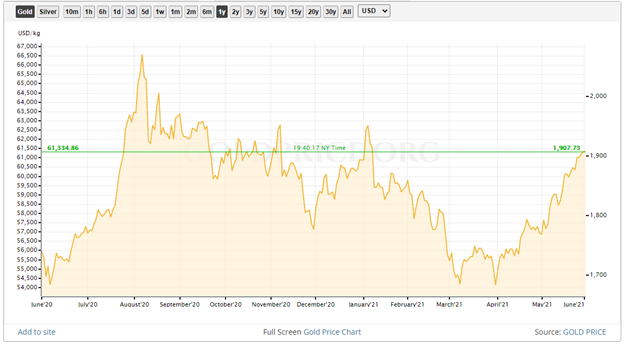

Looking at the chart below, you can see how gold recently broke back above the downtrend line connecting August highs with the peak in January. Gold is now trading back above resistance levels, which is a good indicator that gold prices will continue to climb.

1-Year Gold Chart goldprice.org

Some analysts predict that we could see gold hit new all-time highs, with gold potentially reaching $2,700 in the coming years based on the timing of this latest gold rally.

From the 2016 bottom to a high of $2,063 in August 2020, the previous bull run lasted four years. With the charts signalling that gold prices may have bottomed, we could be at the start of the next gold rally, suggesting now could be the right time to get into gold.

Investors have two ways to invest in gold, gold stocks and physical bullion. While both offer portfolio diversification, they have drastically different risk-return profiles.

Physical gold provides a stable long-term investment. It offers a measure of protection during economic downturns; however, as a physical commodity, there is no potential to benefit from growth. Unlike stocks or bonds, gold itself produces no return – it is a non-productive asset.

On the other hand, gold stocks tend to follow gold price movements; however, they also offer the opportunity to generate a positive return (or loss) based on company performance.

Looking at the XAU (Philadelphia Gold and Silver equities index)-gold ratio can provide investors valuable insight into where gold stocks are trading relative to gold prices.

The XAU is a capitalization-weighted index of companies involved in gold and silver mining. The XAU-gold ratio measures the degree to which gold stocks are undervalued or overvalued by calculating the number of XAU an ounce of gold can buy.

Between 1982 and 2007, the XAU-gold ratio hovered between 0.35 on the high and 0.15 on the low. At 0.15, gold stocks were considered cheap. After dropping as low as 0.04 in 2016, the XAU-gold ratio has now climbed back up to 0.09, which remains extremely low based on historical standards. Analysts are liking gold stocks a lot more than gold right now, and relative to gold prices, gold stocks today are the best buy since the 1980s.

Analysts predict that the XAU-gold ratio could rise from current levels back to or above the highs seen in the 1980s. If the ratio were to climb from 0.09 to 0.35, that would represent a gain of 400% assuming gold prices remain around the $1,900 mark they are at today.

Should gold prices continue their upward trajectory, gold stocks could increase tenfold.

Canada is well known for its mining sector, and for investors looking to buy gold stocks, Canada has some very promising players.

Ascot Resources Ltd. (TSX: AOT)

Ascot Resources Ltd. is a Canadian-based gold and silver exploration and development company currently working to re-start the historic gold-producing Premier gold mine located in British Columbia’s famed Golden Triangle. Collectively referred to as the Premiere Gold Project, the site includes three key deposit areas and several promising exploration targets.

Through the acquisition of IDM Mining, Ascot also holds the high-grade gold and silver Red Mountain Project in its portfolio, positioning the company as the leading consolidator of high-quality assets in the Golden Triangle.

On May 17, 2021, Ascot announced the commencement of the 2021 drilling program at the Premier Gold Project (“PGP”). The company will begin 25,000 meters of surface and underground drilling the last week of May.

First-quarter financial results released in May show the company had a busy and productive first quarter. Permit applications were submitted, and basic engineering was completed at the PGP. The company was also able to raise over $80 million, which, combined with project financing, will continue to fund the PGP.

Newrange Gold Corp. (TSXV: NRG / OTC: NRGOF)

Newrange Gold Corp. is a junior mining company focused on district-scale exploration of precious metals in promising jurisdictions, including Nevada, Ontario, and Colorado. Its flagship Pamlico Project is poised to become a significant discovery within the already prolific Nevada mining region.

A second project, known as the North Birch Project, is in Red Lake Mining Division, Ontario, Canada, less than 2.5 kilometres away from the Argosy Gold Mine, a well-known past-producing gold mine.

On May 13, the company resumed drilling at its Pamlico Project and will be following up on the recent discovery of shallow, high-grade, oxide gold mineralization.

In April, Newrange completed its second and final tranche of a non-brokered private placement of 11,266,597 units, each consisting of one share and one-half share purchase warrant, for total proceeds of $1,351,991.64. Total gross proceeds from the non-flow-through and flow-through financing totalled $3,057,391. 48 and will be used in part to advance the company’s Pamlico Project and North Birch Project.