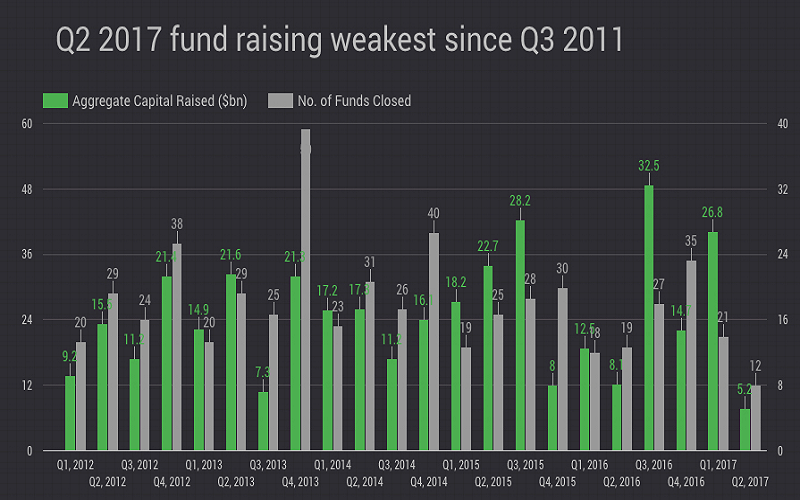

According to a new report by private capital tracker Preqin, overall fundraising for natural resources investment, slowed dramatically in the second quarter of 2017 with 12 unlisted funds securing $5 billion in investor capital.

Q1 2017 saw 21 funds raise a total of $27 billion, and Q2 represents a significant pullback from that level of activity according to the London-based researcher. It marks the fewest funds closed and the lowest level of capital raised since the third quarter of 2011 according to Preqin data.

During Q2, three-quarters of funds that closed were destined to pour the money into energy and seven of the 12 funds will direct investment towards North America. Of the 13 funds looking to secure $7.6 billion in investor commitments none were able to close. Time spent in the market to raise money have also been creeping up and now tops two years.

While oil and gas funds with a focus on the US, Canada and Mexico have always dominated the sector, the lack of fundraising for investment in metals and mining is worrying says Tom Carr, head of real assets products at Preqin:

The lowest levels of quarterly activity for five years or more […] is perhaps to be expected – the natural resources industry remains relatively small, and with so much capital committed over a short period, investors may be pausing before making further commitments to the asset class.

What is of more concern to the growth of the asset class is the continued lack of funds closing to pursue opportunities in industries other than energy. While there are many funds currently in market that are looking to focus on agriculture, timber or mining, these vehicles do not seem to be able to secure capital and hold a final close.

Energy-relates assets have long formed the dominant sector of the industry, but if the asset class as a whole is to continue to grow, fundraising in these sectors must reach a more sustained level of activity.

In 2015 mining and metals made up a paltry portion of funds raised with three funds closing on $1.1 billion in 2015. Last year five funds managed to raise $2.1 billion. 2012 was the peak year for mining fundraising with $4.6 billion of capital commitments from investors.

As of September 2016, the latest data available, natural resources fund managers hold $181 billion in so-called dry powder (funds ready to be invested) says Preqin.

Again mining constitutes only a fraction of the total. At the end 2016 dry powder destined for mining amounted to around $5.5 billion while funds still have to exit $10.7 billion worth investments.

The biggest mining-focused fund is China’s Power Capital which is seeking $3 billon to invest in Asia.

Diversified US-based Energy and Minerals Group did close on $2.4 billion during Q2. According to a November 2016 Preqin survey none of the energy-focused funds are looking to invest in coal assets.

The lacklustre performance of the resources sector stands in contrast to the overall private capital environment.

Preqin says across all investment vehicles and strategies the first half of 2017 is approaching the fundraising record of $384 billion recorded in H1 2008. Given the sharp decline seen in the second half of that year with the Global Financial Crisis, if this pace of fundraising continues, it would make 2017 the largest ever fundraising year for private capital.

Private capital includes traditional private equity such as buyout, venture capital and turnaround funds, private debt including distressed debt and direct lending, and private real estate, infrastructure and natural resources funds.

Source: www.mining.com