There is a lot of talk about cryptocurrency. Even if you only scan the headlines, everyone from major financial publications to obscure crypto subreddit groups are speculating over what will happen to this rapidly growing asset class. This has left some institutional and retail investors to wonder if digital currencies are ready more for mainstream adoption. A few big players like PayPal, Square, and Tesla seem to think so.

Following the crypto market has been a wild ride to say the least. However, a decade later, some of these historically volatile cryptocurrencies have been showing signs of entering a new phase of maturity. 2020 saw the cryptocurrency market swell 188% from $191. 5 billion to $551 billion, and 2021 is shaping up to be even hotter. At the time of publication, market cap for all cryptocurrencies now tops 1.24 trillion.

Editor’s Note: The first Canadian public company to bring defi to investors is Routemaster Capital Inc. (NEO:DEFI), that recently acquired DeFi Holdings. DeFi Holdings is a company focused on investing, incubating and managing trading technologies associated with the fast-growing decentralised finance market. Decentralized finance could be considered the next wave of financial innovation on the blockchain.

While a small subset of retail investors largely fueled past cryptocurrency surges, the enormous growth we’ve seen in 2020/2021 is different. There has been a massive increase in interest from mainstream financial players, as well as the establishment of DEFI, short for decentralized finance, which has opened the door to alternative financial products that have made the crypto market more accessible to traditional equity investors.

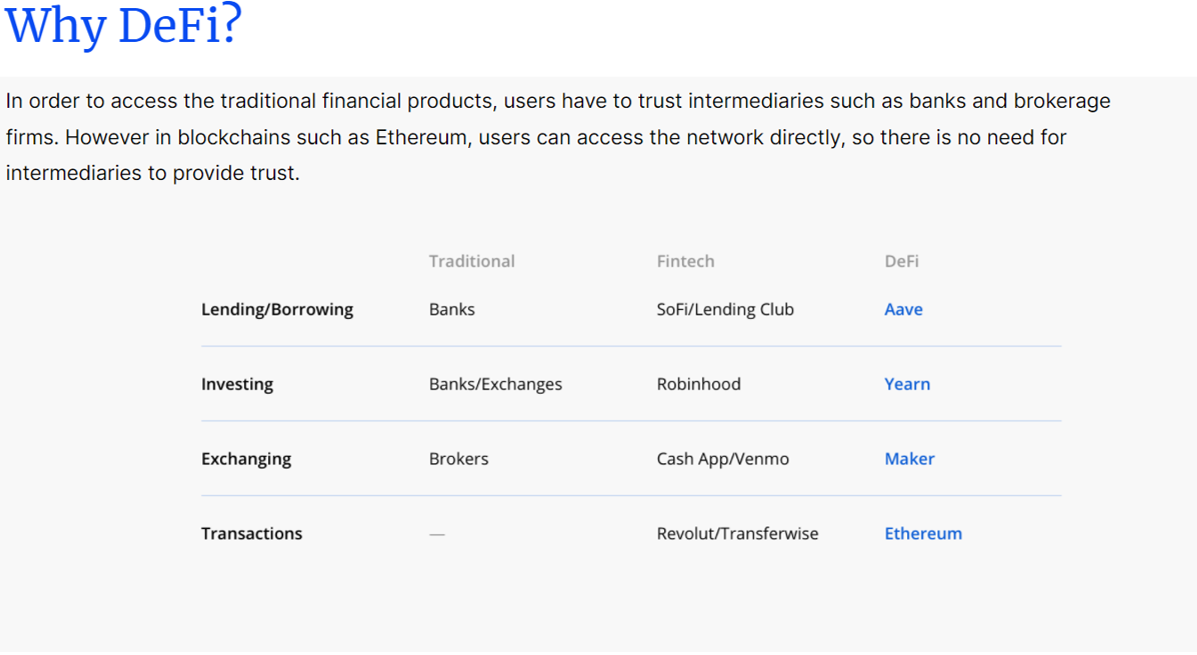

DEFI has emerged as a natural extension of the crypto market, one where transactions between parties are governed by automated smart contracts rather than a central bank. And similar to traditional financial markets, there are exchanges, brokers, and funds that help facilitate loans and other financial products that enable crypto holders to generate significant returns on their holdings.

Simply put, DEFI brings many of the functions provided by traditional banking and brokerage firms into the modern world, allowing for users to directly and transparently conduct financial transactions through the blockchain ecosystem without the need for intermediaries.

Source: DeFi Holdings Inc., a subsidiary of Routemaster Capital Inc. (NEO:DEFI).

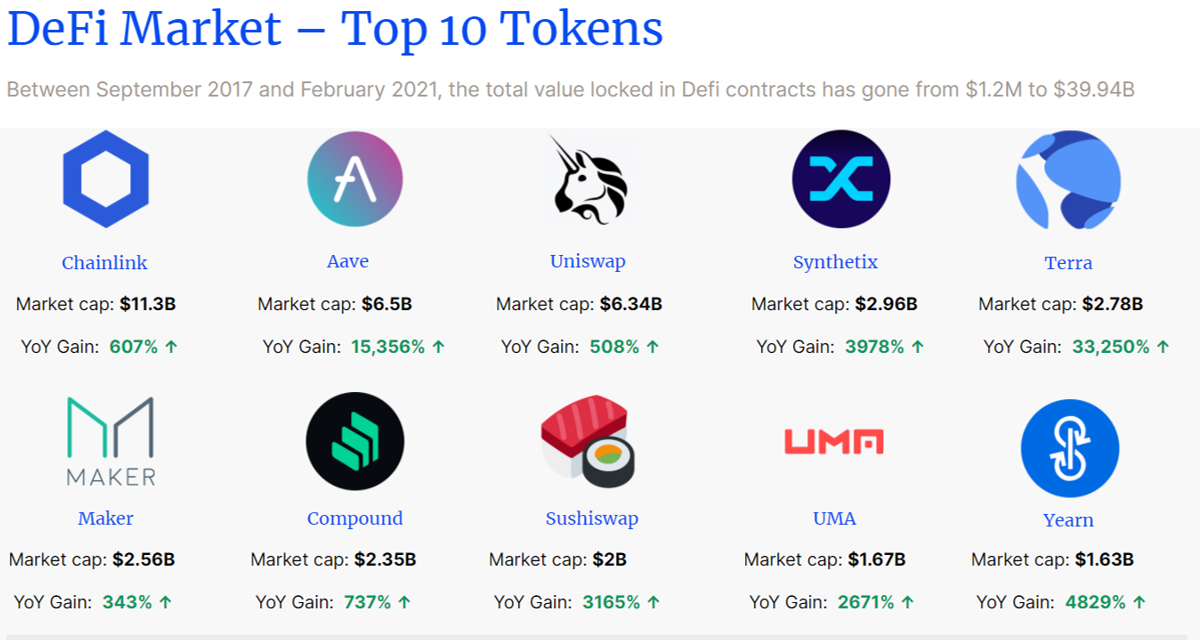

In the past three years, the DEFI market has exploded. Currently, there is over US$26 billion locked up in DEFI contracts, up from only US$2.1 billion 3 years ago.

Source: DeFi Holdings Inc., a subsidiary of Routemaster Capital Inc. (NEO:DEFI) <Download their PPT here>

DEFI Holdings Inc., a subsidiary of Routemaster Capital (NEO: DEFI) is a Canadian cryptocurrency firm that provides hedge fund-like results to investors by bridging the gap between traditional equity investment and the decentralized finance market. The company brings the potential for type of gains seen in the DeFi market to those who may not have otherwise been exposed to the crypto markets.

DEFI Holdings allows investors to gain exposure to this important asset class through their “Three Investment Pillars” approach: investing in DEFI protocols, currencies, and companies, incubating new and innovative companies in the DEFI market through investment, and trading in an actively managed portfolio of DEFI assets.

While still in its early stages, there are several ways to generate passive income within the DEFI landscape through various platforms that reward or incentivize crypto asset holders for providing liquidity to their smart-contract based pools.

Taking a closer look at a few DEFI products, it’s easy to see how this rapidly changing ecosystem is working to provide real returns for smart investors.

Yield farming is a process by which cryptocurrency holders provide liquidity to an asset pool in exchange for income. Yield farming can be compared to a traditional investor investing in bank deposits, fixed-term deposits, or even government bonds, albeit with a slightly higher risk profile.

Yield can be farmed from DEFI money markets, liquidity pools, and other incentives. Yield farmers looking to take advantage of interest rate differentials can also borrow crypto within the DEFI ecosystem to generate a positive return. The highest yields frequently go to those who get in early, so timing is a very important factor.

Currently, a yield farmer looking to generate a return on their holdings needs to manually dig for the best opportunities. However, new protocols, referred to as Robo-Advisors or Robo yield toppers, can help seek out the best yields currently on offer.

The revenue a yield farmer earns can be either in the form of capital growth or through token rewards and transaction fees. In all cases, the investor faces the potential of suffering impairment loss – the risk that an asset’s value may deviate substantially while locked up in smart contracts.

Liquidity mining is a subset of yield farming that provides another opportunity for investors to earn additional yield and token rewards in exchange for providing liquidity to a specific token.

In the DEFI ecosystem, an automated market maker (AMM) helps to provide liquidity to the pool it is operating. Rather than a traditional system of matching buyers and sellers, an AMM enhances yields and supports yield farming and liquidity mining by allowing smart contracts to be traded automatically without permission.

For its part, DEFI Holdings brings an exceptional opportunity to investors looking to take advantage of growth potential within the DEFI ecosystem who may not wish to participate in the crypto market directly. DEFI Holdings founder Oliver Roussy Newton, founder of HIVE Blockchain, is a Canadian crypto expert that has had significant success in leading crypto projects into the Canadian capital markets.

As funds looking to capitalize on the rapidly growing market continue to spring up around the globe, DEFI Holdings (NEO:DEFI) offers investors a diversified team of industry professionals pioneering investment opportunities within crypto banking and finance.

Given the diverging returns offered by competing crypto strategies, investors have traditionally limited exposure to cryptocurrencies to 0.5 to 5 percent of their total portfolio.

However, as we see the DEFI market and cryptocurrencies continue to mature, interest and investment have been tracking upwards. In particular, established funds, such as DEFI Holdings, offers investors an opportunity to diversify their holdings in an environment where the traditionally negative correlation between equity and bonds has become abnormally positive.

We have seen cryptocurrencies reach a new level of market acceptance, with even large established companies, institutional investors, and traditional financial firms looking to benefit from the potential for significant returns. This could be a signal that this asset class is ready for broader mainstream investment.

“Disclaimer: The company described in this article is a customer of NAI Interactive Ltd. This material is for informational purposes only and is not intended as a recommendation or offer or solicitation for the purchase or sale of any securities or financial instruments, or for transactions involving any financial instrument or trading strategy.”