Silver Storm Mining Ltd. (TSXV:SVRS)

Building the Next Latin American Silver Producer.

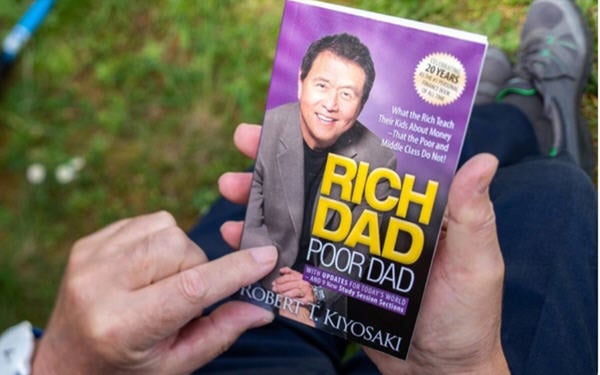

Not looking to ever fall into the poor dad category, “Rich Dad Poor Dad” author Robert Kiyosaki is stashing away gold, silver, and bitcoin in anticipation of a total market meltdown.

Speaking in a recent Tweet, Kiyosaki shared his thoughts on where he believes investors should be putting money right now ahead of what could be a dramatic market crash.

The coming US and Canadian infrastructure plans and the booming EV market will boost the demands for metals. Gold prices have also climbed up. The opportunity is certainly here for mining stocks. What should mining investors put on their watchlist next? The GCFF Virtual Conference 2021 – Global Resource Investment Conference is here to help. Held on Thursday, September 23, 2021, the event will showcase a dozen mining stocks owning global resources. Click here to sign up for free now and tune in to their presentations!

“Bitcoin is booming. Gold is stagnant. Silver is 50% below all time highs” he tweeted. “Dollar is dropping. Silver is the best, lowest risk high potential investment. Bitcoin has the greatest upside. With the dollar dropping Bitcoin and silver are the best investments.”

Kiyosaki believes the flood of government stimulus that helped support the economy through the global pandemic could negatively impact the dollar’s value, possibly even fueling a currency collapse. The Fed has recently signalled that ultra-low interest rates could be coming to an end as early as the end of the year – and Kiyosaki predicts this will lead to plunging asset prices amid a record-hot stock market.

From humble beginnings, Robert Kiyosaki has amassed a substantial amount of wealth as a businessman, investor, and public speaker.

Probably most well-known for his “Rich Dad Poor Dad” series of financial how-to self-help books, Kiyosaki now earns most of his income through speaking events and seminars. His net worth is now in excess of $100 million.

And for those who don’t know, the Rich Dad Company and Rich Global founder has long been cool on cash, frequently using phrases like “cash is trash” and “savers are losers.” Instead, Kiyosaki encourages investors to put their money into something “real.”

When it comes to investing, Kiyosaki has typically emphasized the benefits of putting money to work in an investment that provides passive income opportunities. That may make his newfound fondness for gold, silver and bitcoin a little surprising for some. However, the outspoken investor now admits that he sees more value in precious metals, and silver in particular, than even real estate (an asset he has built significant wealth on and a frequent topic of discussion at his speak events).

So why the sudden change?

Kiyosaki believes there’s intrinsic value in precious metals like gold and silver and that these assets could skyrocket in the coming years, particularly if his anticipated market crash comes into fruition.

Historically, silver has not performed as well as gold during stock market crashes. This can likely be attributed to silver’s heavy use in industrial applications and the fact that market selloffs typically coincide with larger economic downturns. However, it did not perform nearly as poorly as the S&P.

Looking back on several of the most significant stock market crashes since 1970, silver fell by less than the S&P in all but one. What’s more interesting in the current environment is that in cases where a stock market crash was immediately preceded by a bull market, like in 1970, 2009, and what some predict will happen soon, silver either climbed or ended flat.

If prices follow historical precedent, a crash-after-a-bull market scenario could be good news for silver.

If you are to believe Kiyosaki, precious metals could be witnessing significant gains, and soon. Typically, when there is market uncertainty, investors rush to gold. However, current prices – and Kiyosaki – seem to suggest that silver may be the better play. And if you are interested in silver, Golden Tag Resources Ltd. (TSXV: GOG) is a company worth paying attention to.

Golden Tag is betting heavily on silver, with one of the largest undeveloped silver deposits in the world. The Company’s flagship San Diego Property, located in the prolific Mexican Velardeña Mining District, has over 115 million ounces of silver, 1.5 billion pounds of zinc in resources.

On August 24, 2021, the Company completed a Geological Interpretation Program in partnership with Orix Geoscience 2018 Inc. The program will enable Golden Tag to better understand the vast geological resources present in the Company’s wholly-owned San Diego Project.

Following very promising results from a recent dig, the Company has also been working on expanding its drilling capacity. They are currently in the permitting process with the Mexican federal authority, seeking to drastically increase the number of drill pads from 14 to 58.

Compared with a similar group of mineral exploration companies with interests in the region, Golden Tag trades at a lower valuation with a Price/NAV (net asset value) of 7.30x and on an EV/Resource of 0.51x, according to investor group German Mining Network. This is made even more impressive following the Company’s remarkable share performance over the past 12 months, which saw prices surge as much as 1,500%.

With an imposing new management team in place and vast, untapped resource potential, investors would be wise to put Golden Tag Resources on their watch list.

Disclaimer: The company described in this article is a customer of NAI Interactive Ltd. This material is for informational purposes only and is not intended as a recommendation or offer or solicitation for the purchase or sale of any securities or financial instruments, or for transactions involving any financial instrument or trading strategy.